25 February 2010

Please see “troubled hotel loans – workouts, bankruptcies & receiverships” for the latest articles on troubled hotels.

CMBS loan delinquencies — a problem growing every month at a staggering rate.

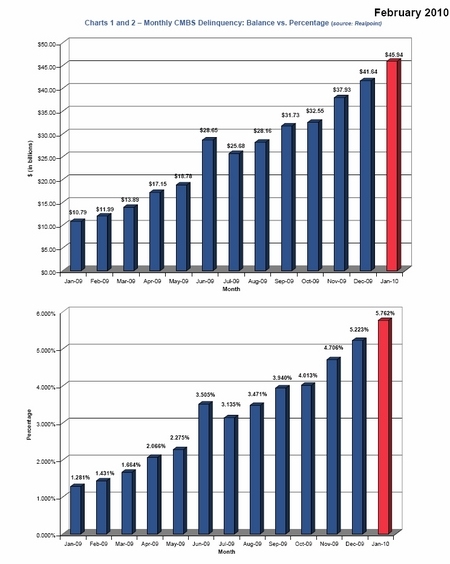

According to the Monthly Delinquency Report issued by Realpoint a few days ago, the total outstanding amount of CMBS (Commercial Mortgage Backed Securities) tracked by that firm is almost $800 billion, of which approximately $46 billion was delinquent in January 2010.

Here is the bullet point executive summary on why tranche warfare is inevitable . . .

The January delinquencies reflect a 326% percent increase from one year earlier when only $10.79 billion was delinquent (for January 2009).

Realpoint projects that these CMBS delinquencies will rise to approximately $70 billion by mid 2010, and predicts that the current trend of ballooning loan delinquencies will continue, as reflected in these two charts.

The CMBS structure became dominant because it was so efficient.

Prior to the current credit crisis, originators of CMBS loans were able to offer attractive rates and terms to commercial mortgage borrowers in part because of the efficient way in which the CMBS issuers were able to pool the loans in REMICs (Real Estate Mortgage Investment Conduits). CMBS issuers offered purchasers of interests in the loan pool (or individual loans in the pool) certificates representing ownership of pieces (or tranches) of the securitized loans or loan pools with different interest returns and priorities of repayment (the higher the priority of payment, the lower the interest rate that could be earned and vice versa).

In larger loans, different return and risk profiles for investors were also created through a so-called A/B note structure, in which the A note has a higher priority of payment and lower interest rate than the B Note. A loan could also be carved up into more notes having different payment priorities and interest rates than just A and B, and ownership of each note could be divided into certificates representing varying payment priorities and interest returns. In some cases, not all the notes may be included in the CMBS loan pool, although pursuant to co-lender agreements among the noteholders, the entire loan will be administered by a single servicer at any given time.

. . . the Servicing Standard requires that the loans be administered in the best interests and for the benefit of all of the tranche holders . . .

CMBS delinquencies and defaults will test conflicts of interest and likely lead to litigation, or “tranche warfare” among the classes of stakeholders

Defaults will cause losses to junior positions. Higher delinquency rates and greater borrower difficulties in refinancing CMBS loans have led and will likely in the future lead to more and more conflicts or “tranche warfare” among stakeholders with different interests in the loans or pools — among the certificate holders with differing priorities and control, the issuers that deposited the loans in the REMICs, those who sold the certificates, and servicers responsible for administering the loans in the REMICs. As delinquencies and subsequent losses mount, those holders of more junior tranches will take the first losses of income and principal. Many will be wiped out, and looking for misdeeds of others that caused their losses. (If only the loan had been liquidated quickly, worked out in a different manner, etc.)

PSAs will set the standard of care. When the expected Tranche Warfare develops, the Pooling and Servicing Agreement (PSA), which is a key formative document in the creation of a REMIC, will map much of the battlefield. The PSA is a long agreement, usually 200-300 pages in length, plus exhibits. The parties to the PSA are (a) the sponsor of the REMIC, usually a Wall Street firm that has assembled the pool of loans from various originators, deposits the loans in the REMIC and sells the certificates representing ownership interests in the loan pool, a trustee (most commonly Bank of America, N.A. (as successor to LaSalle Bank National Association) or Wells Fargo Bank, N.A.), and (b) one or more companies acting as servicers of the loans. Typically, each REMIC has a master servicer that administers the loans until they go into default or are reasonably likely to go into default and a special servicer that administers loans in default or reasonably likely to go into default.

While there is no single form of PSA in use for all REMICs, there are certain common elements typically found in all PSAs.

When the expected Tranche Warfare develops, the Pooling and Servicing Agreement (PSA) . . . will map much of the battlefield.

Typical PSA “Servicing Standard”

The servicing standard is the basic guideline that establishes the duties of the servicers with respect to administration of the loans in the REMIC.

While the Servicing Standard may be expressed somewhat differently in each PSA, certain elements are commonly found in the statement of the Servicing Standard. Given the number of the elements and considerations incorporated in the Servicing Standard in an effort to balance the interests of the owners of the various tranches and the subjective language used, the Servicing Standard is likely to be subject to many different interpretations.

The basic element of the Servicing Standard requires that the loans be administered in the best interests and for the benefit of all of the tranche holders, including those holding pieces of the loans that are not in the CMBS loan pool. However, the servicers are supposed to take into account the relative priority positions of the noteholders. No guidance is provided to the servicers as to how these priorities are to be “taken into account.” As part of the Servicing Standard, the servicers are also supposed to administer the loans in accordance with laws, the PSA and any co-lender or intercreditor agreements among the noteholders. To the extent consistent with the foregoing requirements, the servicers are required to use a standard of care and skill consistent with that the servicer uses for administering loans for its own account or for other third parties, whichever is higher. The servicers are supposed to exercise this level of care and skill with the objective of maximizing the net present value of the recovery of the loan.

. . . the servicers are required to use a standard of care and skill consistent with that the servicer uses for administering loans for its own account . . . with the objective of maximizing the net present value of the recovery of the loan.

Conflicts of interest by servicers

The servicers may have conflicts of interests in servicing the loans based upon the possible ownership by the servicer of a tranche of the loan, compensation arrangements for the servicing, duties to make debt service and protective advances when serviced loans go into default and other business relationships with loan borrowers or other stakeholders.

In cases where the originator or sponsor of the CMBS offering is also in the business of being a special servicer, it may hold the most subordinate tranche and also act as the special servicer, so it is not uncommon for such a conflict of interest to exist. Also, the most subordinate class of certificate holders generally has the right to replace the special servicer, subject to rating agency confirmation, creating another potential source of a conflict of interest for the special servicer.

The final element of the Servicing Standard generally is one requiring the servicers to disregard these conflicts of interest, a worthy objective, but one that is likely to be very difficult for the servicers to do as a practical matter, and one that will undoubtedly be judged with the benefit of perfect hindsight.

In summary, the Servicing Standard is a complex, multi-layered, subjective and ambiguous statement of the duties of the servicers-in other words, fertile ground for each side in the Tranche Warfare to manufacture ammunition for the battle.

The final element of the Servicing Standard generally is one requiring the servicers to disregard these conflicts of interest, a worthy objective, but one that is likely to be very difficult for the servicers to do as a practical matter, and one that will undoubtedly be judged with the benefit of perfect hindsight.

The bottom line: Why tranche warfare is coming

Here is the bullet point executive summary on why tranche warfare is inevitable:

- The dollar volume of CMBS loans is huge

- Loan delinquencies, defaults and losses are soaring and the trend will continue

- Owners of first loss positions will look to make themselves whole if only to discharge their fiduciary duties to their companies, shareholders or other stake holders

- The conflicting interests of special servicers and investors creates a fertile ground for claims

- Lawsuits will explore previously untested provisions of PSAs dealing with the Servicing Standard and other duties of special servicers

- Lawyers who understand CMBS structures and don’t have conflicts with the servicers will be very busy on litigation involving billions of dollars of claims

Other helpful articles on CMBS loans from the hotel lawyers at JMBM’s Global Hospitality Group®

CMBS has been a critical part of the financial structure for hotel and other commercial real estate financing since the RTC pioneered it in the early 1990s. And JMBM’s lawyers have been involved since the beginning. Here are some highlights of other articles on CMBS loans published at www.HotelLawBlog.com that you may find interesting.

Hospitality Lawyer – CMBS loans create new rules of engagement for workouts, January 17, 2001

CMBS Hotel Loans: Is that a train wreck ahead or just a “pig going through the python”?, October 4, 2006

Hotel Attorneys and CMBS special servicers look to have a big (and free!) part of the solution to the liquidity crisis, depressed real estate, and hotel values as well as a better way to dispose of toxic assets. , March 19, 2009

Hospitality Lawyer Insights from MTM: #5. Troubled hotel loans in CMBS – working with special servicers, May 15, 2009

Hospitality Lawyer Insights from MTM: #10. When will CMBS come back?, May 21, 2009

Hospitality Lawyer and Special servicers: Busy now? Realpoint says work will double by year end! Implications for all CRE loans., June 25, 2009

New CMBS rule insights from Hotel Lawyer — effective immediately. Panacea or placebo?, September 16, 2009

Have a question on CMBS? We are happy to see if we can help!

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to unlock value from troubled hotel transactions. Who’s your hotel lawyer?

________________________

Our Perspective. We represent hotel lenders, owners and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is a founding partner of JMBM and Chairman of its Global Hospitality Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

JMBM’s troubled asset team has handled more than 1,000 receiverships and many complex insolvency issues. But Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. For example, they have developed some unique proprietary approaches to unlock value in underwater hotels that can benefit lenders, borrowers and investors. (GOOGLE “JMBM SAVE program”.)

Whether it is a troubled investment or new transaction, JMBM’s Global Hospitality Group® creates legal and business solutions for hotel owners and lenders. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.