27 July 2008

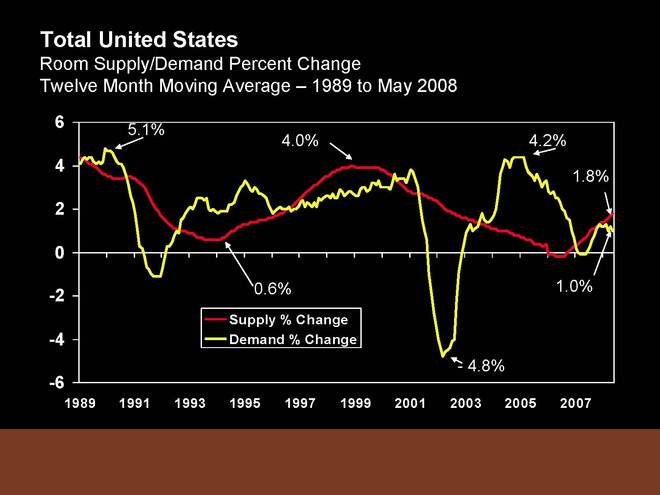

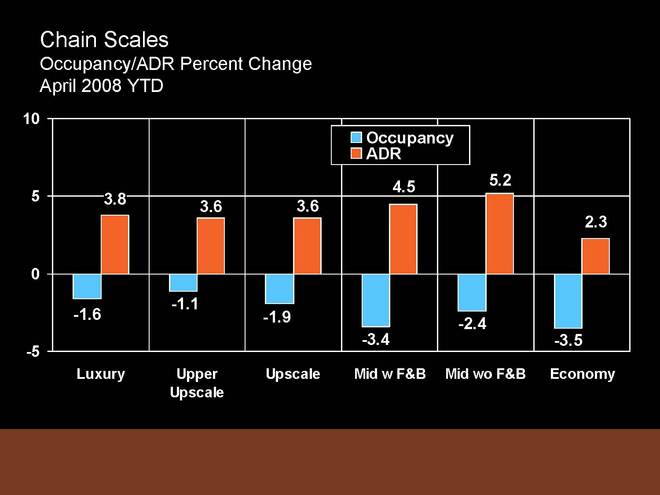

Hospitality Lawyer — Why we need to maintain the discipline to keep ADRs up! As hotel occupancy rates are tending to soften nationally, the data from Smith Travel Research (STR) tells us that the industry has continued to do well because average daily rates (ADRs) have continued to rise, particularly in the Top 25 markets, and in the market segments that STR calls Luxury, Upper Upscale, Upscale and Midscale without Food & Beverage.

But there is a new threat to industry profits looming on the horizon — something beyond pestilence, war, recession, and falling airline seat capacity, and this is within our own control if we will just behave rationally. Here’s the scoop from www.HotelLawBlog.com.

An easy answer: Just keep it up! (ADR that is) . . ..

The Problem of price cutting and downward spirals.

What’s the problem? Occupancy starts going soft, because fewer people are traveling. Maybe it’s the economy, airline cutbacks, the weather or whatever. To address the problem, one savvy hotel owner or operator decides to start lowering rates to attract more customers and increase gross revenues. He or she will make a little less on each room at the lower rate but, with higher occupancy, hopes to increase total revenues and profits.

But in my example I said that fewer people are traveling, so if the now-cheaper hotel starts “stealing” customers from the competition, the competition will strike back with their own rate cuts. Maybe they undercut the first guy, or the second guy, which evokes further rate cuts by more hotels. Pretty soon, a price war erupts with a downward spiral that goes on for a long while and is very hard to stop.

After a very short time of this destructive behavior, we get serious “price compression.” Let’s say that before the price war, a night at the ACME Hard Budget hotel costs $50 and a night at the ULTRA Luxury Hotel & Spa costs $450, with all the other competition somewhere in between. But in a “normal” competitive market the price difference between to two extremes was $400.

In the last two major hotel downturns (marked by troughs in 1991 and 2002), this price differential decreased or “compressed.” In 1991, the ACME Hard Budget Hotel might have cut its rate to $35, barely enough to pay the staff and the utilities, much less debt service. But the ULTRA Luxury Hotel & Spa ultimately cut its rate to $150 a night — or less. In other words the price differentials between all the market segments squeezed into a much smaller (and less profitable) range.

Don’t get too pessimistic.

In case you have not looked recently, check out the news from Smith Travel Research here at www.HotelLawBlog.com. The presentations at NYU on the State of the U.S. Lodging Industry and Chain Scales is directly on point, both as to how maintaining ADRs is sustaining the industry in a softening demand environment, and why things aren’t going to be very bad.

THE TRAGEDY — one that did not need to happen.

The tragedy of the price cutting spiral is that it doesn’t help any hotel owner! The shrinking base of customers remains the same, and is divided by the hotels in roughly the same proportion as before, because everyone starts cutting prices to maintain market share.

Time to wake up and keep it up!

Do you feel like you have heard this before? You have!

Smith Travel Research

At the NYU Hotel Investment Conference about a month ago, Randy Smith reported (see Pearls from NYU):

The damaging practice of “discounting” to maintain market share (and its downward spiral) has NOT emerged. There is no indication that discounting is a successful strategy to maintain or improve profits.

Cornell University and STR study

This intuitively sound principal has been confirmed by a study conducted by Smith Travel Research and Cornell University’s School of Hotel Administration. According to Cornell Professor Cathy Enz, co-author of the 2003 study, “Price Discounting – Is It a Wise Strategy to Raise Revenues?” At the time, Enz was executive director of the Center for Hospitality Research at Cornell’s Hotel School. Here is what they concluded:

“The prevailing wisdom is that reducing room rates entices new consumers to enter the market and buy more rooms . . . This has never worked for the hotel industry, and it won’t work in this era of proliferating hotel room discounts and Web-based travel deals, because new consumers do not enter the market in response to hotel discounting. Instead, existing consumers simply get more for less, and hotel revenues fall.”

The study, conducted by Enz, Hotel School Associate Professor Linda Canina and Mark Lomanno, president of Smith Travel Research (STR), is the first step in better understanding the impact of discounting on the lodging industry. Using STR data, the researchers analyzed industry-wide practices and came up with these findings:

• Discounting damages hotel revenues because it does not improve sales and fails to increase demand in most industry segments.

• The prevalence of pricing inconsistency on the Web may exacerbate the problem, as consumers are able to find lower prices for the same hotel room on a variety of Web sites.

• Hotel companies’ own promotions and packages, featuring discounted rates on premium rooms, may further erode revenue without adequately increasing demand.

You know what to do. It just takes the discipline. So let’s get it right this time, OK?

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and more than 100 hotel mixed-used deals in the last 5 years alone. Who’s your hotel lawyer?

________________________

Our Perspective. We represent developers, owners and lenders. We have helped our clients as business and legal advisors on more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” or “hotel mixed-use” or “condo hotel lawyer” and you will see why.

Jim devotes 100% of his practice to hospitality, representing hotel owners, developers and lenders. Jim leads JMBM’s Global Hospitality Group® — a team of 50 seasoned professionals with more than $87 billion of hotel transactional experience, involving more than 3,900 properties located around the globe. In the last 5 years alone, Jim and his team have assisted clients with more than 100 hotel mixed-use projects — frequently integrated with energizing lifestyle elements.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.

Jim is frequently quoted as an expert on hotel issues by national and industry publications such as The New York Times, The Wall Street Journal, Los Angeles Times, Forbes, BusinessWeek, and Hotel Business. He is the Conference Chairman of The Hotel Developers Conference™ and Meet the Money®.

Contact him at jbutler@jmbm.com or 310.201.3526. For his views on current industry issues, visit www.HotelLawBlog.com.