12 May 2009

Hospitality Lawyer Insights from Meet the Money® 2009: The hospitality lawyers of JMBM’s Global Hospitality Group® have presented an annual hotel conference for 19 years. On May 5-7, 2009 in Los Angeles, California, nearly 400 industry leaders gathered at the Sheraton LAX for Meet the Money® 2009.

Presentations from Hotel Industry thought leaders by JMBM’s hospitality lawyers

The PowerPoint presentations from a number of industry leaders at Meet the Money® 2009 are listed with hyperlinks at JEWELS from Meet the Money® 2009 — the “best ever” hotel conference.

Commentary and observations from the hospitality lawyers of JMBM and other industry experts on some of the critical industry issues are available at Hospitality Lawyer Insights.

Here is the latest in the Hospitality Lawyer Insights series on some of the most critical issues of our day.

Here are the insights provided by hotel industry leaders at Meet the Money® 2009 on the issue of “recovery”.

Suzanne Mellen:

Suzanne R. Mellen CRE MAI

Managing Director

HVS International

(415) 268-0351

smellen@hvs.com

“We look for a serious recovery in 2011. Then the question is how long will it take to get back to where we were.

Appraisals are forward looking. We typically build in a rebound – first in occupancy, and then in rate. We are projecting a 5-year recovery now, and in some properties a 6-year recovery. It was 7 years in the 1980s. But it will be market by market and property by property.”

Mike Cahill on LIIC study:

Michael Cahill, CRE, MAI, FRICS, CHA

CEO and Founder

HREC – Hospitality Real Estate Counselors

303-267-0057

mcahill@hrec.com

Michael Cahill is a co-chairman of the Lodging Industry Investment Council (LIIC) as is Jim Butler, Chairman of JMBM’s Global Hospitality Group®. LIIC serves as the leading industry think tank servicing the hospitality business. All together, the members of LIIC represent acquisition and disposition control of billions of dollars in lodging real estate. The hospitality industry’s most influential investors, lenders, corporate real estate executives, REIT’s, public hotel companies, brokers and significant lodging equity sources are represented on the council.

LIIC’s recent survey of members indicates the majority believe that lodging real estate investment will get worse before it gets better. The recession will last up to 18 months or more and hotel values will continue to decline.

Henry Vickers:

Henry Vickers

Director

AEW Capital Management LP

617-261-9205

hvickers@aew.com

“What is the “new normal”? We don’t expect to get back to 2007 levels until the next cycle after the first recovery from now.”

Jonathan Falik:

Jonathan Falik

Chief Executive Officer

JF Capital Advisors

212-681-7040

jonathan@ifcap.com

“The problem is asymmetrical information which causes a fundamental disconnect between lenders and borrowers, and gives them very different expectations. Lenders are getting information in arrears. They are not even getting pace reports. They don’t see what is happening now and going forward. They are always a month or two behind what is going on. So here we are in May 2009, and lenders are maybe getting reports on March or April. They probably are not even getting a revised forecast. This is “Asymmetric Information.”

Until lenders have same view of market as borrowers, there will be no resolution of the markets.”

Thomas Corcoran:

Thomas Corcoran

Chairman of the Board

Felcor Lodging Trust Incorporated

972-444-4901

tcorcoran@felcor.com

“At the Real Estate Roundtable a couple weeks ago, Bernanke addressed the group. He seems very smart and listens a lot. He said, ” You will begin to see things get better in weeks — not months.” He said that in October, our financial model almost fell off a cliff. We are not falling off the cliff any more. That is positive.”

Jonathan Falik:

“We will see RevPAR increases within 6 months after GDP pops, consumer confidence increases.”

Richard Green:

Richard Green

Director

USC Lusk Center for Real Estate

213-740-4093

richarkg@usc.edu

Richard thinks that housing is the ballgame right now. Going back to WW II, there has been no better leading indicator than housing. This last 6 months has been the worst housing market since WW II.

Housing defaults are still not at Great Depression levels yet (10%) but we are getting there. Our 90-day delinquency rate is about 7%. There is a lot of stress on households. Contributing to the stress is household debt to GDP, which was 40% after WWI, going up to 60% in 1980. This was acceptable because rent was just another household expense. But after 1980, household debt to GDP has skyrocketed and is now over 100%.

So we will not see the consumer driving the economy any time soon.

David Loeb:

David Loeb

Managing Director

RW Baird & Co

414-765-7063

dloeb@rwbaird.com

Beware of false bottoms! Things are still getting worse in the economy. This is not the bottom. There are more shoes to drop.

RevPAR declines are severe. They have not bottomed and the hotel industry has not bottomed yet, either. In fact, we have not stopped the accelerated decline. The 3-month moving average will go down for April. Maybe it won’t go down quite as much in May, but it will still be bad.

And there is more. The continuing increased supply problem is not over, but the worsening demand issue is debilitating.

Smith Travel Research likes to use a slide with light at the end of the tunnel. David uses this one and asks, “Is it light at the end of the tunnel, or is it an oncoming train?”

Mark Woodworth:

Mark Woodworth

President

PKF Hospitality Research

404-842-1150

mark.woodworth@pkfc.com

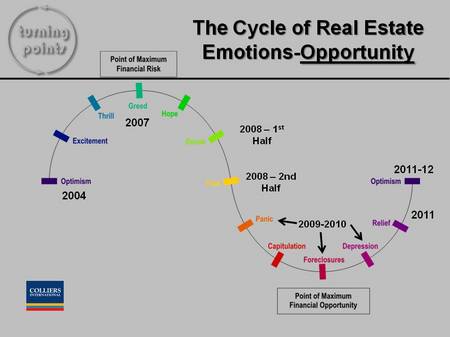

This chart so shows the PKF projections on where we are in the hotel cycle of emotions and opportunity. We are in a period of capitulation foreclosures and depression that will last through 2010, with relief beginning to appear in 2011, and optimism coming only in 2011 or 2012.

This slide emphasizes that the time of greatest financial opportunity is in 2009 and 2010!

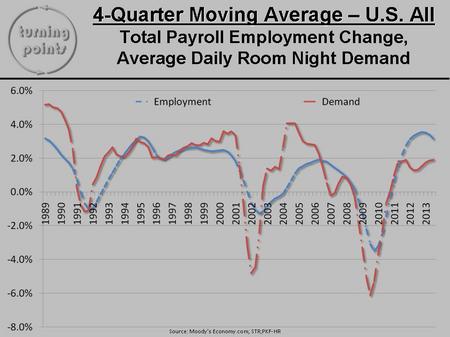

As measured by a 4-quarter moving average, employment and hotel room demand do not start positive growth until 2011.

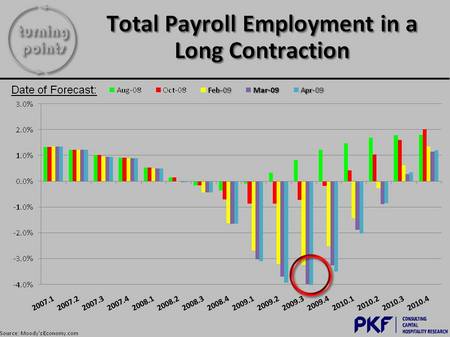

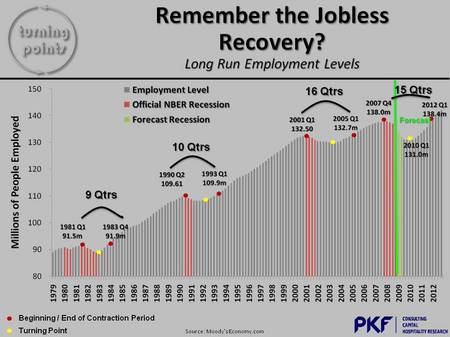

PKF projects that the employment levels affected by current recession will not return to pre-recession levels of Q4 2007 for 15 quarters. They will not return to pre-recession levels until Q1 of 2012.

We are not projected to hit the bottom of employment levels until Q1 of 2010, when employment levels will have decreased by more than 7 million jobs.

Many more jobs will be lost before they turn around, roughly a year from now in April 2010, when unemployment peaks at 9.8%.

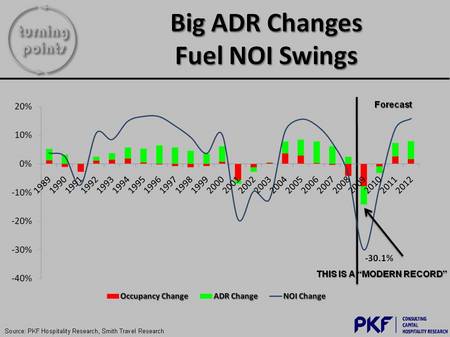

Big ADR declines will set any “modern record” in NOI declines for the hospitality industry as shown in this chart. This will be the first time since 1936 that NOI was down 30% or more. In part this is because of the confluence of 3 factors

Mark Woodworth points out that there have been 122 recessions around the world between 1960 and 2007. Only four of those 122 recessions had all three of the following factors:

- Credit crunch

- Housing price bust

- Equity price bust

Mark calculates that with all three of these depressing conditions, GDP declines are 2 to 3 times greater.

When do we get out of this mess?

I don’t know. But there is a lot of pain to endure before we get back to what we thought was normal. We do believe that the next 12-18 months represent the greatest buying opportunity in our lifetime, and that it may well be a long time (7 years or more) before we get back to 2007 levels of profitability and value, on an inflation-adjusted basis. We hope it is sooner.

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to unlock value from troubled hotel transactions. Who’s your hotel lawyer?

________________________

Our Perspective. We represent hotel lenders, owners and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is a founding partner of JMBM and Chairman of its Global Hospitality Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

JMBM’s troubled asset team has handled more than 1,000 receiverships and many complex insolvency issues. But Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. For example, they have developed some unique proprietary approaches to unlock value in underwater hotels that can benefit lenders, borrowers and investors. (GOOGLE “JMBM SAVE program”.)

Whether it is a troubled investment or new transaction, JMBM’s Global Hospitality Group® creates legal and business solutions for hotel owners and lenders. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.