17 May 2009

Hospitality Lawyer Insights from Meet the Money® 2009: The hospitality lawyers of JMBM’s Global Hospitality Group® have presented an annual hotel conference for 19 years. On May 5-7, 2009 in Los Angeles, California, nearly 400 industry leaders gathered at the Sheraton LAX for Meet the Money® 2009.

Presentations from Hotel Industry thought leaders by JMBM’s hospitality lawyers

The PowerPoint presentations from a number of industry leaders at Meet the Money® 2009 are listed with hyperlinks at JEWELS from Meet the Money® 2009 — the “best ever” hotel conference.

Commentary and observations from the hospitality lawyers of JMBM and other industry experts on some of the critical industry issues are available at Hospitality Lawyer Insights.

Here is the latest in the Hospitality Lawyer Insights series on some of the most critical issues of our day.

#6. What’s happening with hotel values today?

Compared to 2006, NOI has been cut in half for the hotel industry.

Suzanne Mellen:

Suzanne R. Mellen CRE MAI

Managing Director

HVS International

(415) 268-0351

smellen@hvs.com

“As everyone knows, hotel values are on a bad downward trend. People ask, “How do you value anything?” They say there are no values in markets like this. Actually, there always is a value, but you just have to work at it. That is what we do at HVS.”

Click here for Suzanne Mellen’s “Hotel Values and Cap Rates 2009”.

Bernard N. Siegel:

Bernard N. Siegel

Principal

KSL Capital Partners, LLC

(720) 284-6440

bernard.siegel@kslcapital.com

“Valuation is the biggest issue in the industry. The bid-ask gap is narrowing and it be will be forced to narrow more. When that occurs, we will invest $850 million. We aren’t afraid to take on some risk, but it has to make sense. Valuation will create activity.”

John Arabia:

John Arabia

Senior Lodging Analyst

Green Street Advisors

949-640-8780

jarabia@greenstreetadvisors.com

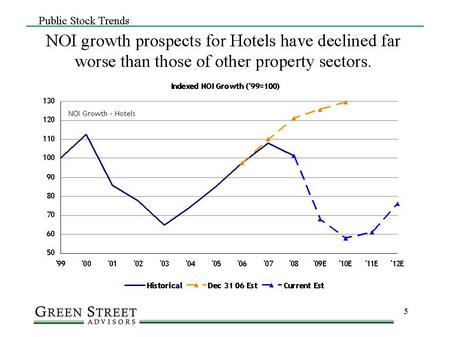

“The real estate industry has been hit badly by the economy. But the Hotel Sector is considerably worse than real estate in general. Compared to 2006, NOI has been cut in half for the hotel industry.”

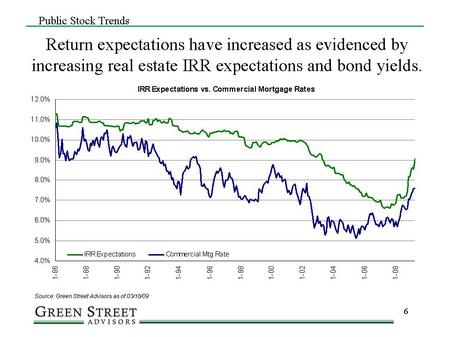

“But it was not just NOI expectations that have changed — return expectations have changed too. Note that in 2002 -2006, IRR expectations declined materially.”

Nothing has crashed this hard, this fast, in this industry since the Great Depression.

Russ Urban:

Russ Urban

Senior Vice President, Development

HEI Hotels and Resorts LLC

203-849-2279

rurban@heihotels.com

“When we look at an asset, valuation is the single most important issue. Structure is second. You end up spending all your time on valuation these days.”

Patrick O’Neal

Patrick O’Neal

Vice President

Midland Loan Services, Inc.

913-253-9623

patrick.oneal@midlandls.com

“The hardest time to determine value is in rapidly rising and rapidly declining markets. Right now, we are seeing more than a rapid decline. What do you use as comps? Nothing has crashed this hard, this fast, in this industry since the Great Depression.”

Suzanne Mellen:

“Using investor sentiment surveys can be misleading as the market is changing faster than the data collected.”

Larry Broughton:

Larry Broughton

President and CEO

Broughton Hospitality Group

714-848-2224

lb@broughtonhospitality.com

“It’s going to be hard to maintain value for assets purchased in 2006 and 2007. A lot of value happens from the management of the hotel. I am amazed at how many operators were blindsided. But, in the long run, we are going to have better businesses and leaner properties.”

When we look at an asset, valuation is the single most important issue. Structure is second. You end up spending all your time on valuation these days.

Kevin Mahoney:

Kevin Mahoney

CEO

Stonebridge Companies

303-785-3100

kmahoney@stonebridgecompanies.com

“What are we doing on value? There is so much you can do for value enhancement. We renegotiate with all our vendors for everything from trash removal to fire inspection. We have reduced incentive agreements. There is a lot that you can do to save money. We are never done negotiating an agreement. We always ask, “Is that all you can do?” We also look for additional ways to generate revenue by whether it is renting out a roof top for a cell phone antenna or a parking garage.

Richard Green:

Richard Green

Director

USC Lusk Center for Real Estate

213-740-4093

richarkg@usc.edu

When commenting on the Public Private Investment Program (PPIP): “Geithner’s plan could work if the market values assets correctly. Geithner believes assets are undervalued.”

Suzanne Mellen:

“Before you hire an appraiser, interview them and find out about their process. Do you want an appraisal for market value — a willing buyer and a willing seller? For liquidation value because you are under duress to sell in 60 days? Or for disposition value where you are not under “fire sale” pressure, but want to sell in 6-8 months? These are all different appraisal standards and require different approaches.”

Kevin Mahoney:

“Our industry needs to be aware of how the passage of the Employee Free Choice Act will affect value. It is a critical issue that could erode value.”

Bernard N. Siegel:

“Everything goes back to valuation. There is an enormous reset in pricing going on. As it occurs, we will invest. There is actually less risk now than in ’07 when we were asked to invest in record-high EBITDA.”

Suzanne Mellen:

“We think to reflect market value — a willing buyer and a willing seller — a refi makes sense. Add 10 percent value when you refi for the future.”

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to unlock value from troubled hotel transactions. Who’s your hotel lawyer?

________________________

Our Perspective. We represent hotel lenders, owners and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is a founding partner of JMBM and Chairman of its Global Hospitality Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

JMBM’s troubled asset team has handled more than 1,000 receiverships and many complex insolvency issues. But Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. For example, they have developed some unique proprietary approaches to unlock value in underwater hotels that can benefit lenders, borrowers and investors. (GOOGLE “JMBM SAVE program”.)