8 January 2011

Hotel Lawyer with advice for 2011: Hotel Investors, take note!

Like it or not, the stage is now set. This is the time. The year 2011 will present one of the greatest hotel buying opportunities for many years to come. And if you are not buying hotels this year, you will miss the window created by one of the biggest economic downturns in American history. What are the key indicators as to why this is a great time to by a hotel? And is price alone enough to justify the purchase, or are there other factors you need to think about? If the market is heading north, can you still make a bad purchase?

Hotel Lawyer Guy Maisnik, Vice Chairman of JMBM’s Global Hospitality Group®, who was the lead attorney for the Receiver in the recent sale of the Sheraton Universal Hotel, answers these questions and more.

So, You Think You Want to Buy a Hotel?

For savvy investors, the time could be right

by

Guy Maisnik | Hotel Lawyer, JMBM Global Hospitality Group®

Investors, Take Note!

Hotel investors who delay investment for another year or two in search of the holy grail of the bottom of the market or the “perfect” opportunity will surely kick themselves. I can hear my uncle Bernie’s gruff old world voice: “Oy, I coid a had that hotel for a song compared to prices today.”

If there is one thing true in real estate investing, it is this: when prices are in a free fall, the average investor believes prices will keep falling. That same investor will believe prices will continue to rise when prices are rising. So in these declining market transitions, the average investor will…do …nothing. Only in hindsight, will the average investor regret his indecision. Savvy investors — the 3% who know how to make money no matter which way the market is trending — know what the rest do not: smart investment decisions do not need to be made at the bottom or top of a market.

Savvy investors buy or sell when key market indicators tell them to do so. Moreover, savvy investors know that they cannot time the market. By waiting, they know they would miss a key opportunity, and then be left scrambling like the rest of the herd. Hotel investors who delay investment for another year or two in search of the holy grail — the bottom of the market — or the “perfect” opportunity will surely kick themselves. I can hear uncle Henry’s gruff old world voice, “I could of had that hotel for a song compared to prices today.”

Subject to some nasty surprises, most experts now believe we are at or near the bottom the economic cycle in the hotel industry, and have started an upward inflection. Key indicators:

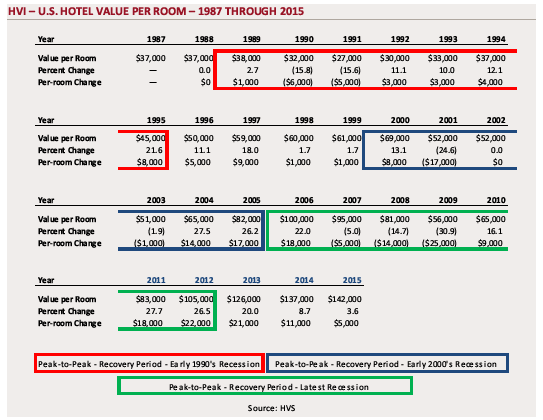

- Hotel values per room are back to where they were in 1996, without adjusting for inflation, and HVS believes that hotel values have already increased more than than 10% nationwide for 2010.

- Debt financing for existing hotels is improving significantly (enhancing liquidity and value), while development and construction financing for new hotels is virtually non-existent, restraining the influx of new supply and competition for existing hotels.

- Hotel industry fundamentals are improving from the worst collapse since the Great Depression, and look to get much stronger in second half of 2011 and are poised for double digit growth for the next three or four years.

- Prices for construction labor and materials have fallen since 2008, with the costs of steel tubing falling by 20%, fabricated structural materials by 14% and pre-pressed concrete and drywall materials by 10%.

- While prices are deflating, government leaders are positioning their currencies for inflation as one of the cures for their debt problems. The net effect will be inflated asset values with a corresponding reduction in debt and investor losses, and further heightening the risk of waiting for the bottom.

- If a hotel can service debt now (or as restructured), in this economy, it is hard to imagine a better time to purchase.

Some investors will rush blindly into this opportunity for buying hotels at a discount. Many of them will be new to the hotel industry. Many will fail to understand the critical business and legal issues that create big opportunities or significant risks. This article explains why and the things of which to be mindful.

First thing to remember: All opportunities are not equal. The difference will be that which separates the savvy investors from the average investors. But all hotel investors should observe a few cautions as they get back in the game. (See also “Don’t Forget the Fundamentals in Hotel Investing” below.)

Facts about timing

Timing is important. Buying after a long down-market cycle is always safer than jumping in at the top of the bubble. This is the easy part. The difference for the savvy hotel investor is reasonable timing + hotel knowledge acumen. Acquiring a quality project, in a good location, with solid due diligence and conservative buying standards is the key to success.

Buy early

In the 90s there were only a handful of opportunity funds buying assets. Then the major players (Colony Capital, Oaktree Capital, JER, Whitehall/Goldman Sachs, etc) snapped up cheap assets from the RTC when the average investor remained on the sideline. But there were relatively few opportunity funds then. Today, there are more than 700 of such opportunity funds holding enormous amounts of capital and waiting to pounce, hoping to recreate what the funds did in the high-flying 90s . Most will miss the mark, and instead will come late to the market, serving only to drive prices higher.

Today, lenders are lending at hotel loan to value ratios (LTVs) in the 50-60% range, and debt service coverage (DSC) requirements around 1.5 times the debt service payments, margins 450-550 basis points over LIBOR and requiring full guarantees. These requirements are applied to historically depressed values and cash flows. At some point, lending on hotels will become extremely competitive again, and when that occurs, the savvy hotel investor will refinance and pull out a large majority of its cash and significantly reduce if not completely eliminate its guaranty. It’s an oddity that leverage increases as values rise, and LIBOR spreads shrink dramatically and debt service coverage shrink as revenues approach bubble peaks. Can you really afford not to buy now in this part of the investing cycle and miss the benefits of a more liberal lending?

There are other big advantages to those who get in the game early.

Property values and cash flows early in the cycle

According to Smith Travel Research, from August 2008 through 2010, the hotel industry lost $17 billion in hotel revenue. That is $41 million lost revenue per day from 215,000 fewer rooms sold per day. Almost 60% of the revenue decline was due to lower room rates, and the other 40% was due to lower demand. Further, industry wide, hotel expenses have dropped on average by 22%. Accompanying these deteriorating hotel industry fundamental metrics was a punishing loss of hotel value. Hotel values dropped 15% in 2008 and a whopping 31% in 2009.

Just look at this chart of hotel valuations from HVI and consider whether you would have preferred to buy a hotel at the cyclical lows in hotel valuation (such as in 1992-1995, or in 2002-2003 just after 9-11) based conservative cap rates applied to extremely low trailing 12 month actual NOIs.

According to HVS, RevPAR growth for 2010 was about 4.3%, resulting from about a 5.3% increase in occupancy. Increases in occupancies will continue to offset rate declines, with RevPAR fully rebounding by 2013. On average, it appears from the HVI that peak U.S. hotel values in 2006 was about $100,000 per room and the valley in 2009 was about $56,000 per room. There will no doubt continue to be challenges with unemployment at 9.6% and the government’s latest downward revisions to GDP. However, overall, based upon the data available today, this is the time to re-enter the hotel market.

Avoiding the pitfalls in hotel purchasing

While we believe that now is the best time to buy a hotel, anyone wishing to take advantage of this window of opportunity should know a few critical issues and avoid some dangerous pitfalls.

Hotels are only 50% real estate. The other 50% is an operating business. Thus, no doubt you need a team of veterans that understand the cornerstones of buying good real estate, such as location, marketable title, environmental hindrances, sufficient structural and building systems, and so forth. Equally as important, your team needs to understand how to make that hotel sing for this purchase to be a good investment. The average investor will buy a hotel simply looking for costs to cut, causing an immediate increase in the cap rate. But that solution does not work for long.

All the right elements have to be in place for that hotel’s business to ignite and catch fire. The hotel needs to have the right legal and business team [(http://www.hotellawblog.com: how to find the right hotel manager)] and proper management structure. Your hotel manager can either be your best friend or your worst enemy, so it’s important to get this hire right on the front end. The right management team will clearly understand the particular market segment for your hotel, how to market your hotel, how to enhance revenue and contain costs. A solid management team will know how to improve the value of your hotel. You can afford to pay the fees and charges required by your hotel manager and make the improvements it requires if your hotel is hitting the right returns. If, on the other hand, your management team is not driving revenues properly, the wrong management agreement can be your worst nightmare.

Don’t forget the fundamentals in hotel investing

There are no guaranties.

But one way to improve your odds is with experienced legal counsel who understands the elements of your hotel, and what it takes for your management agreement to be structured properly. As a general rule of thumb, the right hotel management agreement can improve your hotel’s value by 25%. Likewise, the wrong hotel management agreement will decrease your hotel’s value by 25%. Can you afford a negative 50% swing in your hotel’s value? Experienced legal counsel will also understand a host of other issues relating to your hotel: operations, employees and labor unions, transient occupancy taxes and other relevant taxes, cash management accounts, the traps in franchise agreements, special hotel insurance requirements, tax benefits in owning a hotel versus other real estate investments, security, liquor licensing, and intellectual property issues.

Conclusion

The hospitality industry may be emerging from a historic depression with great opportunity for investors. However, investors must realize the distinctive nature of hotels as compared to traditional commercial real estate. The operating business and unique legal principles concerning hotels require the use of industry hotel experts for consulting and legal services. If investors properly evaluate their hotel with the right assistance, then those investors have a tremendous prospect for making sound investment decisions. And, based upon key market indicators, that time is NOW.

Guy Maisnik is Vice Chairman of JMBM’s Global Hospitality Group®, and recognized as a leading hotel lawyer. He was the lead lawyer representing the Receiver in the recent sale of the Sheraton Universal Hotel. Contact Guy at 310.201.3588 or MGM@jmbm.com.

HOW TO BUY A HOTEL — Free handbook

Until the free handbook on HOW TO BUY A HOTEL is published (expected soon), you can access all the materials on this subject at www.HotelLawyer.com. Look on the right hand side of the home page and click on “Buying & Selling a Hotel.”

Here are

a few of the articles on the subject under this topic:

Buying a hotel? Financing a hotel? 10 things every borrower should know. (part 1)

Buying a hotel? Financing a hotel? 10 things every borrower should know. (part 2)

Can I use the EB-5 Visa Program for financing hotel acquisition and renovation?

Seller representations and warranties in a hotel purchase agreement — What are the big issues today?

How to buy a hotel — What you don’t know about undocumented workers could really hurt you!

HOW TO BUY A HOTEL Handbook: Franchise issues in hotel purchase and sale transactions

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to help investors be successful in bidding for hotel acquisitions, and helping investors and lenders to unlock value from troubled hotel transactions. Who’s your hotel lawyer?

________________________

Our Perspective. We represent hotel lenders, owners and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is a founding partner of JMBM, and Chairman of its Global Hospitality Group® and Chinese Investment Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.