02 January 2014

Hotel Lawyer: Some lessons for the rising interest in golf.

Golf courses are back in popularity — for play, purchase and sale, and development. Whatever your involvement, you will likely find today’s article by my partner Guy Maisnik to be interesting and helpful in avoiding unnecessary losses.

Some other articles on golf are referenced at the end of this article.

BUYING OR BUILDING A GOLF COURSE —

DUE DILIGENCE IS KEY

by

by Guy Maisnik | Vice Chair of JMBM’s Global Hospitality Group®

“It took me seventeen years to get three thousand hits in baseball. I did it in one afternoon on the golf course.”

― Hank Aaron

Golf is a difficult business where one third of the courses operate at a loss.

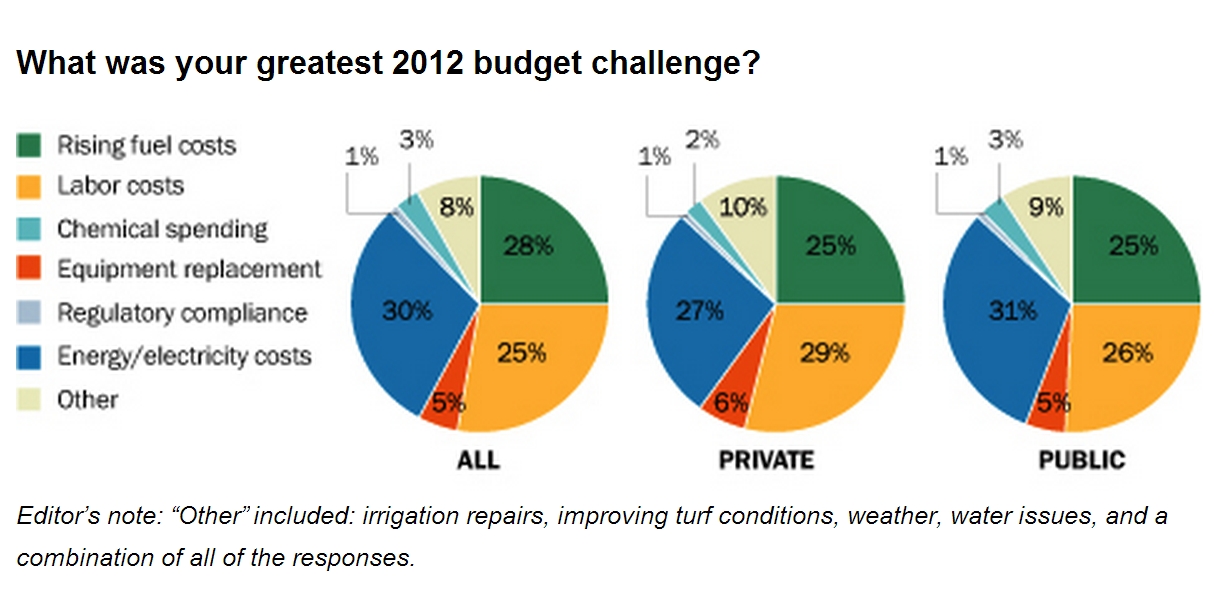

Playing isn’t the only thing difficult about golf. Try operating the business and staying solvent. Profitably operating a golf course is one of most challenging of hospitality businesses. At first glance, it would seem easier than most businesses. Not a lot of moving parts. Relatively few employees (average of 30 on season and 10 the off-season). Large barriers to entry to locate available space (average 150-200 acres for 18 holes). Golf is hugely popular. There are approximately 27-30 million golfers in the U.S. Yet, according to a National Golf Foundation survey (February 10, 2012) of about 750 golf course superintendents, only about a third of those surveyed were profitable. Just a third! With the exception of private facilities (35 percent), less than a third broke even, and a third of private courses and more than 40 percent of public courses lost money. See the breakdown of costs provided by Golf Course Industry, GCI’s State of the Industry report 2012, which is still relevant today:

What is your objective?

Given the challenges of successfully owning and operating a golf course, the first point of any developer or purchaser of a golf course is to get clear on the objective. In other words, if nearly two-thirds are unprofitable, why are we doing this? Will golf be an amenity to a hotel or housing development that will sufficiently increase value to justify the golf course? How will maintenance and operating costs be covered, golf revenues, homeowner fees, club dues, user fees, increase hotel revenues or public support? Or, if the golf course is a stand-alone purchase, can it really stand alone? In other words, how is acquiring or building a golf course justified financially?

Due diligence.

From the available data on those courses that either broke-even or lost money, one can readily see how important due diligence is when purchasing or building a golf course. Not all golf courses are the same. They can be designed, built and operated quite differently. Those differences can mean tremendous value or huge associated costs that cannot be justified. Some require more maintenance than others. Water is a large variable depending on the part of the country and the source of water. Similarly, there are regional variances depending on grass types and climate for items like seed, chemicals and fertilizers. There are issues with rising fuel costs, labor costs and equipment replacement. Deferred equipment purchases can make ownership more difficult. Increased repair costs and additional downtime for equipment has a cost that also needs to be considered.

The key for any purchaser is to understand where the value is lost and gained. Can labor be trimmed? Will capital equipment purchases or leases make sense if they reduce operating costs, and over what period of time? Are there alternative fuel or water possibilities? Can grasses be modified to account for greater sustainability? Are there creative and viable options for funding equipment replacement? Has the seller/owner taken advantage of all revenue enhancement techniques? What has been the marketing strategy to-date? Are golf fees in line with the current market? What feasibly adjustments and enhancements can be made? A skilled golf course consultant can help a buyer answer these questions.

Liabilities — hidden and apparent.

Further, golf courses are a breeding ground for lawsuits. Golf and legal issues can be found in every square inch of a golf facility. From defective golf carts to improperly designed fairways; from wetlands to wrongful serving of alcohol to minors. Are all entitlements in place? Are all liquor licenses proper? Will the new buyer inherit some old tax problems? Are there any potential environmental hazards? Streams, wetlands and other water features can create habitat for a number species, sometimes endangered species. Certain fertilizers and pesticides can be toxic. If those toxins are in the water features, there can be run off onto adjacent property, causing liability to the golf course owner. There have been significant environmental claims and lawsuits against golf courses for this very reason. Are there boundary encroachments on or from the golf facility that have been ignored?

Golf is a dangerous game. It essentially involves whacking a bone crushing projectile in unpredictable directions at speeds that can exceed 200 mph. How safe are the golf carts and the terrain they operate on? The liability cannot be ignored, and insurance is not the entire answer. Are there any offsite errant ball conditions that should be addressed? Have there been homeowner claims? Many such claims contend faulty golf course design. Redesigning can be extremely costly. If the golf facility has a club or association, are all books and records kept to date? How viable is the club? How many gift certificates are outstanding that could impact value? Are all employees qualified and legal? Training new employees can be costly? Is the equipment (e.g., golf carts) owned or leased? If the latter, will the leases be paid out of purchase price proceeds? Will the course design subject the owner to possible claims under the Americans with Disabilities Act? These are only a few of the questions. This checklist of legal due diligence is much more substantial and must be investigated. A skilled hospitality lawyer can help a buyer answer these questions.

The bottom line.

The point is no buyer should acquire a golf course without having answers to all the necessary questions to determine whether the purchase makes sense. Few buyers are capable of doing this work with their own staff. A Buyer needs to understand the facility’s true value, its short-comings, where revenues can be enhanced and costs contained and what it will take to get there, and where the lawsuits lurk. No buyer wants a bag of costly legal problems. The best way to mitigate against a bad purchase is to engage solid consultants with the right business and legal expertise and experience who can handle many golf courses and can efficiently evaluate the viability of the purchase. The right team can identify the key issues and pitfalls and either design a plan to mitigate them or steer a buyer from a poor purchase altogether. Either way, the goal is to help a buyer make a smart decision in a business where it’s too easy to end up on the wrong side of the club.

Other golf articles by Hotel Lawyers

If you would like to find more articles on golf, hotel development or mixed-use, go to www.HotelLawyer.com and use the GOOGLE-like search bar at the top right, or scroll down and look for topics on the right hand side of the page in red type (and click to open up that category of article).

Otherwise, here are some articles relating to golf courses that our readers have found valuable:

New ADA compliance standards for golf courses. What do they mean to you?

Security interest in golf course revenues cut off by Bankruptcy.

Guy Maisnik is a partner and Vice Chair of JMBM’s Global Hospitality G

Guy Maisnik is a partner and Vice Chair of JMBM’s Global Hospitality G

roup®, a senior member of JMBM’s Chinese Investment Group®, and a partner in the Real Estate Department. Among other real estate and hospitality assets, Guy is a legal expert in buying, selling, building and financing golf courses and related equipment. He has nearly three decades of commercial real estate finance with a strong expertise in hotels and hospitality assets. Guy’s practice is both domestic and foreign, where he has advised on matters throughout the United States, Asia, Mexico, Canada, South America, Caribbean, Eastern and Western Europe, Australia and the Middle East. He has been recognized in The Best Lawyers in America®, California Real Estate Journal’s Best Real Estate Lawyers, Los Angeles magazine’s Top Southern California Lawyers, as well as a Top Real Estate Lawyer in Real Estate Southern California magazine. For more information, please contact Guy Maisnik at 310.201.3588 or mgm@jmbm.com.

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to unlock value from hotels. Who’s your hotel lawyer?

Our Perspective. We represent hotel owners, developers and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or +1 (310) 201-3526.

Jim Butler is a founding partner of JMBM, and Chairman of its Global Hospitality Group® and Chinese Investment Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.