13 October 2008

Hospitality Lawyer with the latest update on the Financial Crisis or “Turbulence.”

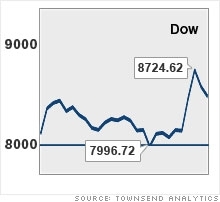

A few days ago, some were calling the Dow’s 2,400 point collapse in 8 days a “crash” but others insisted that a “crash” requires a drop of 20% or more in a single day or two days. Therefore, they call the recent collapse in stock indexes a “cascading crash” or a “slow motion crash.” It was pretty fast for most of us, with a 1,000 point swing between high and low on Friday (October 10) — the first time that has happened in its 12-year history.

The “Turbulence”

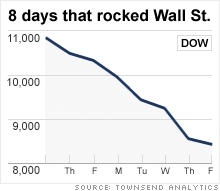

CNN called it the “8 days that rocked Wall Street” and showed it this way:

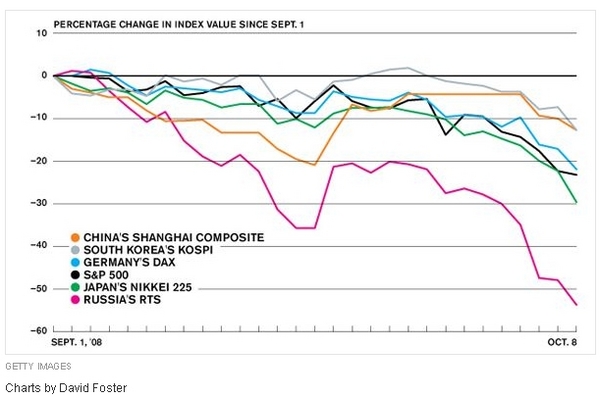

And as the chart below shows, the Dow had company with stock indexes around the world.

How did we get here? And how did the U.S. problem become “global”?

As we all know, the bad news is not limited to the Dow. The Financial Crisis or “Panic of 2008” may have started with the “mortgage crisis” but it has spread globally. A year ago, this little cartoon was making the email rounds, but somehow it still sums up how much of this began. [Warning: This cartoon has been circulating for more than a year. I still have not seen a better “explanation” for the mortgage crisis. But please don’t view it if you are offended by strong language.]

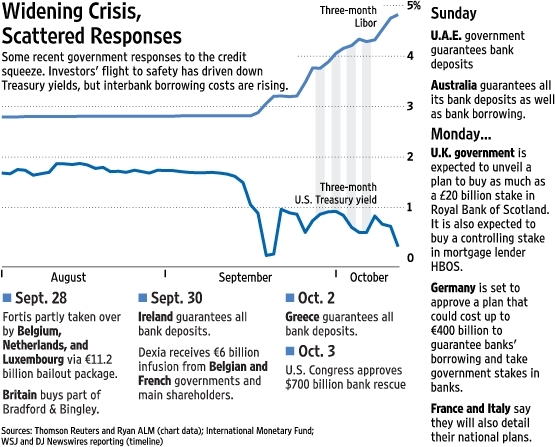

A year that separates all the others – The Great Divide

Will 2008 be the The Great Divide? Bear Stearns sold to JP Morgan, Lehman forced into Bankruptcy, Merrill Lynch sold to Bank of America, Goldman Sachs and Morgan Stanley converted to bank holding companies, the U.S. government taking an 85% controlling position in AIG, Countrywide sold, WaMu seized and liquidated, California and Massachusetts looking for Federal funding because they can’t sell bonds, nationalization of Freddie Mac and Fannie Mae, Fed guarantee of money market funds, a $700 billion Federal bailout, Fed intervention to buy commercial paper directly from private issuers, Wachovia in a shotgun marriage to Citibank, no, Wells Fargo . . . Banks don’t trust banks and LIBOR goes to historic margins over Treasury bills . . .

From Wall Street Journal, October 13, 2008

Now, according the October 13 Wall Street Journal, a forced partial nationalization of 9 major banks (including preferred equity stakes in Goldman Sachs, Morgan Stanley, J.P. Morgan Chase, Bank of America, Citigroup, Wells Fargo, Bank of New York Mellon and State Street Corp.) with $125 billion and another $125 billion to soon be invested . . . Several of these institutions were reportedly unhappy about the investment but effectively had no choice.

But in June 2008, at the NYU Hotel Investment Conference, I watched a luncheon presentation where the economic expert explained how the old rule was now repealed . . . the one that said “when the U.S. catches a cold, Europe sneezes.” He was saying how the rest of the world had become “immune” to the U.S. financial woes, and in fact, it would be a strong Europe and Asia that would hasten the U.S. recovery.

Now it looks as if that prediction was about as accurate as the “New Economy” that accompanied the dot com boom . . . and disintegrated in its bust. Now Governments around the world are taking extraordinary steps to bolster the viability of their banks and economies. This is a serious global situation which changes daily. Iceland is facing potential bankruptcy and looking to Russia for a bailout because the U.S. cannot help. The U.K. plans a £37 billion ($63 billion) into Royal Bank of Scotland Group PLC and the soon-to-be combined HBOS PLC and Lloyds TSB Group PLC. Germany approves a rescue package of up to €500 billion ($670.65 billion) to shore up the country’s financial system. The plan includes up to €80 billion in fresh capital, up to €400 billion in bank guarantees and €20 billion to back up the guarantees. Germany has already fully guaranteed consumer deposits. French President Nicolas Sarkozy said his government will provide up to €360 billion to help banks stay afloat through the financial crisis. The money includes €320 billion to guarantee bank refinancing and another €40 billion for a government-backed financing vehicle to provide banks with the capital they need.

So where are we and where are we going?

No one really knows what is going to happen, but there are many reasons to think that we may have hit bottom or be very close. Stock market veterans talk about market capitulation being necessary before an economic recovery. Many thought that Friday, October 10 was “capitulation.”

Why do I even reference the stock market as relevant to the economy? Because at this time I think it reflects the investment community’s confidence in the stability of the financial system. And confidence in the economy is critical to stability of the entire system and restoration of liquidity.

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and more than 100 hotel mixed-used deals in the last 5 years alone. Who’s your hotel lawyer?