28 September 2009

Hotel Lawyers’ insights from The Lodging Conference at the Arizona Biltmore. As our Global Hospitality Group® members compared notes from last week’s Phoenix Lodging Conference, we had some observations we wanted to share. Congratulations to Morris Lasky and Harry Javer for another great event.

Here is our take on what happened in Phoenix . . .

The Lodging Conference 2009, Phoenix, Arizona

This conference has been one of my favorites for many years. The Arizona Biltmore is a beautiful facility. The weather is usually fantastic, and the informal atmosphere promotes a relaxed environment for doing business.

The program did not disappoint in any of these areas in 2009. There were about 1,000 participants in attendance — a few less than last year and perhaps fewer lenders. But the major players were there and it was easier to talk with people with a slightly smaller crowd.

The hotel industry mood

At one level, the mood of the conference was more optimistic than one might anticipate from the current state of the industry and its prospects. There were reports of transactions for smaller hotel properties and notes — particularly at the $10 million-and-under level.

While hotel brokers say that transaction volume is down a stunning 97% from last year, in just the last 30 days, many lenders have issued a flood of requests for Broker Opinions of Value or BOVs. The brokers are hoping that lenders’ rush to understand collateral value means that lenders are preparing to take action, whether that is selling notes or REO.

Liquidity

Liquidity is still a dominant problem. But it seems that the public stock markets may be opening for IPOs, like Hyatt’s, and David Loeb or RW Baird thinks that by this time next year there may be 3 or 4 lodging IPOs providing fresh equity capital to the industry. Some even claim to see trickles of new debt, but any debt available is underwritten on “reset values” based on current NOI and cap rates, with 50-60% loan to value and roughly 1.5 times debt service coverage from available cash (generally discounted to reflect further market adjustments).

In other words, this debt (where you can find it) won’t help anyone invested at 2005-2007 prices.

The elephant in the living room is still there

The real problem that the optimists want to ignore (like the big white elephant sitting in the living room) is that hotel industry NOI continues to fall. Falling NOI will not recover for a while, and when it does, it will take considerable time to get back to former levels. In the meantime, more and more hotels are unable to meet debt service, and many increasingly cannot pay operating expenses like payroll and utilities.

So what?

While we are waiting for things to get better, somebody is going to have to do something. Who is going to meet the shortfall in payroll and utility bills? And while the brands have eased their strict enforcement of brand standards for many situations this past year, this cannot continue indefinitely. Sooner or later, additional investment will have to be made in the properties to maintain their competitive position with other properties being bought at deep discounts and upgraded to take advantage of the situation.

When does hotel industry NOI recover?

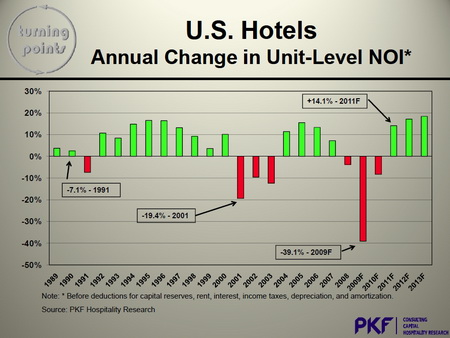

I thought one of the most thought-provoking (and disturbing) slides I saw at the conference came from Mark Woodworth, President of PKF Hospitality Research. Here is the slide and why it looks so important to me.

Note that NOI is projected to have dropped about 4% for 2008, 39.1% for 2009 and 10% for 2010, before it hopefully starts growing at about 14-15% in 2011, 2012 and 2013. (By the way, the data Mark used is only one of the likely scenarios predicted by Moody’s with something like a 53% likelihood, and all of the other scenarios are more negative. )

This decreasing NOI is needed to pay debt service and bills. It is the same income that most investors are going to scrutinize and apply a cap rate to — a cap rate that is at least 200 basis points higher than it would have been in 2007, and maybe more. So income and values will continue their downward path for 2009 and into 2010.

The problem of percentage improvements from a new reset base level

Do the math:

Although 2008 was not a great year for the hospitality industry (after the Lehman bankruptcy), let’s use 2008 NOI as the starting point.

Then, apply the PKF projections for NOI to decrease in 2009 by 39.1% and then by 10% in 2010.

It takes 4 years of these compounding NOI increases — until 2015 — before you get back to the 2008 starting point. This is using the NOI increases projected by Mark Woodworth of 14% in 2011, and 15% in each year thereafter.

Some people think that we are likely to have another recession by 2013 or 2014, before we get to the recovery point. And remember, there is almost a 50% chance that the economic assumptions underlying the projections will turn out to be worse than those used for the calculations.

What does this mean for the hotel industry?

Unfortunately, the data keeps confirming continued declines in hotel income and values for a long time, with a very slow recovery. See the detailed discussion at The Hotel Owner’s and Hotel Lender’s Dilemma: Sell now or sell later? . If you aren’t prepared for this scenario, then get out now before it gets worse.

If you haven’t yet read “The Black Swan,” by Nassim Nicholas Taleb, I would highly commend it to you. This New York Times bestseller lays out a now-popular theory about high-impact, highly improbable events that have an extraordinary affect on the world. These events can be either negative like World War I or the September 11, 2001 attacks, or positive like development of the personal computer and the Internet.

We find ourselves in the current financial crisis because of something that might be called a negative Black Swan event. But, while the hotel industry grapples with how to service debt and pay bills with deteriorating fundamentals for another year to 18 months, a “good” Black Swan event could come along and help us jump out of this mess a lot faster than it looks like we otherwise will.

The idea of Taleb’s book is not to predict Black Swans, because they are so rare and improbable that they cannot be predicted. But being able to identify and exploit the positive Black Swan events is as critical as surviving the negative ones.

Keep looking for the Black Swan!

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to unlock value from troubled hotel transactions. Who’s your hotel lawyer?

________________________

Our Perspective. We represent hotel lenders, owners and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is a founding partner of JMBM and Chairman of its Global Hospitality Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

JMBM’s troubled asset team has handled more than 1,000 receiverships and many complex insolvency issues. But Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. For example, they have developed some unique proprietary approaches to unlock value in underwater hotels that can benefit lenders, borrowers and investors. (GOOGLE “JMBM SAVE program”.)

Whether it is a troubled investment or new transaction, JMBM’s Global Hospitality Group® creates legal and business solutions for hotel owners and lenders. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.