21 February 2013

Hotel Lawyers with Lodging Industry assessment: Demand is strong, supply is weak. RevPAR is healthy. What’s not to like?

We continue to receive calls from hotel owners, developers, investors, lenders, and members of the media asking, “What is the hospitality investment outlook for 2013 and beyond?”

There is a growing optimism among industry veterans and many of them are revitalizing acquisition (and a few development) projects. The level of activity has kicked up a notch or two.

One thing that everyone likes: barring unforeseen events, the stage is set for continuing improvement in hotel industry fundamentals and hotel valuations for at least 5 years – through 2017.

This presents a very attractive backdrop for investors, and experienced investors are already putting their plans in motion.

1. Fundamentals: What the numbers say

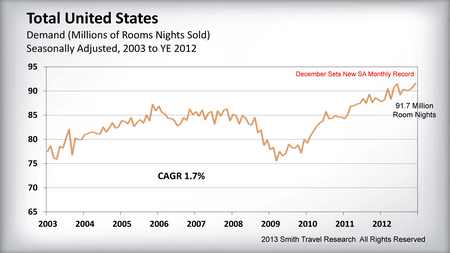

Demand – Room Nights Sold. All of the fears that have been endlessly rehashed these past few years — an uncertain economy, continuing high levels of unemployment, the election, the fiscal cliff, troubles in Europe — did not prevent business or leisure travelers from taking trips and staying at hotels. In fact – good news – hotel room demand for the 4th quarter of 2012 was quite robust, with December setting an all-time record.

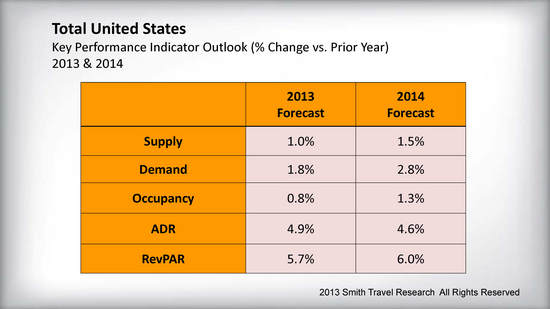

Occupancy. After the Great Recession, recovery in the hotel sector was led by occupancy growth at the expense of rate, as hoteliers sacrificed rate to fill their hotels. Although demand continues to set new records in absolute terms, the demand growth is slowing. Occupancy growth was 4.2% in 2011 but slowed to 2.4% in 2012. It is projected to dip to 1.8% in 2013 before kicking up a bit to 2.8 in 2014.

Rate. Now the story is all about rate. Rate growth in both 2011 and 2012 was 3.8% in the US, but is projected to grow at 4.9% in 2013 and 4.6% in 2014.

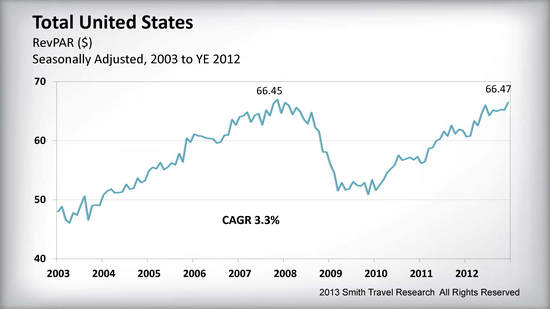

RevPAR. Of course, RevPAR growth is the factor that computes the combined effect of occupancy rate and rate growth. Coming off the lows of the Great Recession, RevPAR grew at 8.2% and 6.3% respectively for 2011 and 2012.

On a national basis, 2012 was the year that RevPAR finally matched the peak levels of 2008, before Lehman Bros. failed and the nation plunged into recession. (The prior peak level will not truly be matched, on an inflation-adjusted basis, for a couple of more years.)

RevPAR is projected to grow at 5.7% and 6.0% for 2012 and 2014. To put this into perspective: until the past few years, RevPAR growth of 5-6% would have been at the high end of 30-year averages. These are healthy numbers.

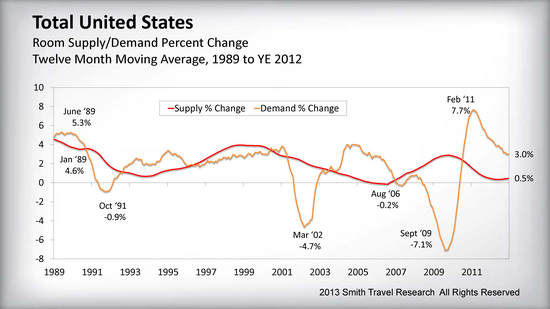

Supply. This is where the picture gets even better. The supply pipeline is now below the long-term average, and is expected to grow at 1.0% and 1.5% in 2013 and 2014. The hotel industry typically hurts itself, on a cyclical basis, building more hotel rooms when fundamentals are strong. That did not happen this cycle, so we are not dealing with the negative effects of oversupply. This is one reason that fundamentals continue to look good through at least 2017.

2. Forecast for 2013 and 2014

Our friends at Smith Travel Research (who provide the industry with data) recently shared with us their 2013 and 2014 forecast for the key performance indicators. Here is the forecast.

What does it all mean?

JMBM’s Global Hospitality Group® is committed to the success of the hospitality industry and we are encouraged to see that the numbers bear out a solid recovery of the industry!

- We see a period of steady, continuing improvement over the next 5 years.

- We believe the robust recovery of 7 of the top 25 markets will spread to virtually all of them. The feeding frenzy to buy hotels in New York, San Francisco, Los Angeles, Miami and Boston will spread to other major urban areas, and even to secondary and tertiary markets as buyers look for value and find it.

- The exceptional improvement that has been enjoyed by the luxury and upper segments of the business will spread down the food chain.

- Hotels will be added to major regional malls and shopping centers over the next several years. Studies of current hotel-retail mixed-use projects have proven there are powerful competitive advantages for both the hotel and the retail components in these mixed-use settings. The retail sector has recovered sufficiently, and owners want to harvest the synergies of having a major hotel component in their malls. Many of them have the cash to do it and are moving forward with plans that have been shelved for the past few years.

- Hotel mixed-use projects are on the drawing board everywhere. These kind of projects are successful whether the other uses are retail, residential, office, sports, or entertainment. Mixed-use projects nationwide have proven this and hotel mixed-use developments will flourish when financing returns for construction.

- Generally, hotel development will be significantly constrained by lack of construction financing. Where it is appropriate, developers will use funds generated through the EB-5 Immigrant Investor Visa Program as part of the capital stack.

NOW is probably the time to buy hotels

The hotel industry has stabilized and is in an environment that will steadily improve for the next 5 years. This is a very attractive scenario for investment and now is the time to buy a hotel!

See “So you think you want to buy a hotel? Well, NOW is probably the time to do it! ”

The hotel lawyers with JMBM’s Global Hospitality Group® can help you find the right team members to guide you through the complex process of a hotel acquisition. We can help evaluate the opportunity, identify the issues that affect the hotel’s value, resolve issues that hinder the transaction and close the deal.

If you feel the timing is right for you to buy a hotel, you may want to check out our resources on that subject (see below).

HOW TO BUY A HOTEL — Free handbook

Until the free handbook on HOW TO BUY A HOTEL is published (expected soon), you can access all the materials on this subject at www.HotelLawyer.com. Look on the right hand side of the home page and click on “Buying & Selling a Hotel.”

Here are a few of the articles on the subject under this topic:

An Overview of the Hotel Acquisition Process (30-page booklet)

Buying a hotel? Financing a hotel? 10 things every borrower should know. (part 1)

Buying a hotel? Financing a hotel? 10 things every borrower should know. (part 2)

Can I use the EB-5 Visa Program for financing hotel acquisition and renovation?

Seller representations and warranties in a hotel purchase agreement — What are the big issues today?

How to buy a hotel — What you don’t know about undocumented workers could really hurt you!

HOW TO BUY A HOTEL Handbook: Franchise issues in hotel purchase and sale transactions

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and have developed innovative solutions to help investors be successful in bidding for hotel acquisitions, and helping investors and lenders to unlock value from troubled hotel transactions. Who’s your hotel lawyer?

________________________

Our Perspective. We represent hotel lenders, owners and investors. We have helped our clients find business and legal solutions for more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is a founding partner of JMBM, and Chairman of its Global Hospitality Group® and Chinese Investment Group®. Jim is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” and you will see why.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.