Tom Corcoran, Chairman of the Board of FelCor Lodging Trust, speaks with David Sudeck, senior member of JMBM’s Global Hospitality Group® at JMBM’s 2016 Meet the Money® – the national hotel finance and investment conference. They discuss “rational debt,” redevelopment opportunities, and the evolution of FelCor.

A transcript follows the video. See other videos in this series on the Jeffer Mangels YouTube channel.

David Sudeck: I’m David Sudeck, I’m at the 26th annual Meet the Money® conference with Tom Corcoran, the founder of FelCor Lodging Trust. Thank you for joining us. You just got off your panel and you did a great job, so thank you for that. I wanted to hear about in this uncertain time, 2016, where you see us in the market at this point and how it may differ from 2015.

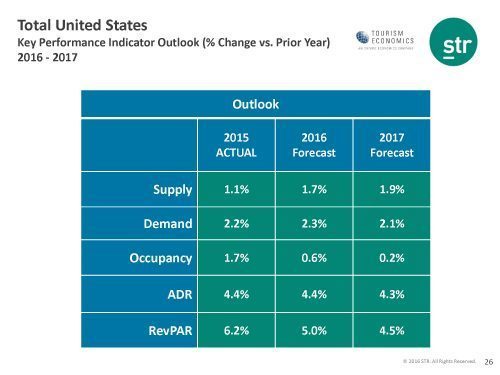

Tom Corcoran: Actually, I think it’s going to be a lot like ’15. I think ’16 and ’15 are going to be very similar. I think we’re going to continue to have positive RevPAR above the GDP and so I think it makes a lot of sense to me that the industry remains very strong; robust. There’s some clouds out there, people are trying to say there’s a storm coming, and I just don’t happen to believe there is. I think those clouds are artificially made up and aren’t really in the real world.

David Sudeck: My experience is some of our lender clients are pulling back in terms of the provisions, particularly of construction lending.

Tom Corcoran: Yeah, I think that’s probably good, I’m okay with that. When people go through getting nervous before things really are bad, it has the net effect of acting as a governor – which is why I call it a governor – because it kind of stops irrational lending. Most people believe supply is the worst enemy of the hotel industry and I would argue that it’s debt that creates the supply. The source, historically, of all the downturns has been where people have borrowed too much money – even in some of the worst cycles we’ve gone through – people had non-recourse, 100% financing. Then people can build hotels that make no rational, economic sense at all.

David Sudeck: So where do you see opportunities in this market given the lack of liquidity? I think that the number of hotel developers is going to shrink, supply will pull back to some extent. Do you see any specific opportunities in this marketplace? CONTINUE READING →