Author of www.HotelLawBlog.com

3 February 2008

Hotel Lawyer reading the Smith Travel Research tea leaves from the ALIS Conference. A few days ago, Mark Lomanno made one of his great presentations at the ALIS (Americas Lodging Investment Summit) Conference to a ballroom packed with most of the 3,100 registered delegates. All were eager to hear the latest data, in order to see where we have been and where we are going. As usual, Mark was kind enough to share his latest slides. You don’t want to miss this!

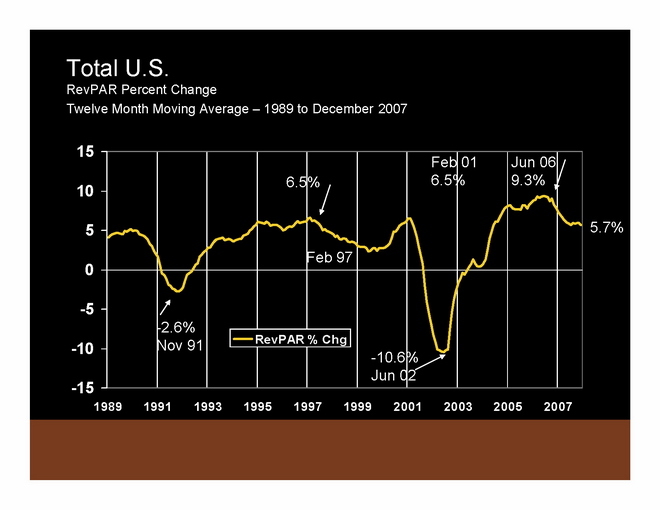

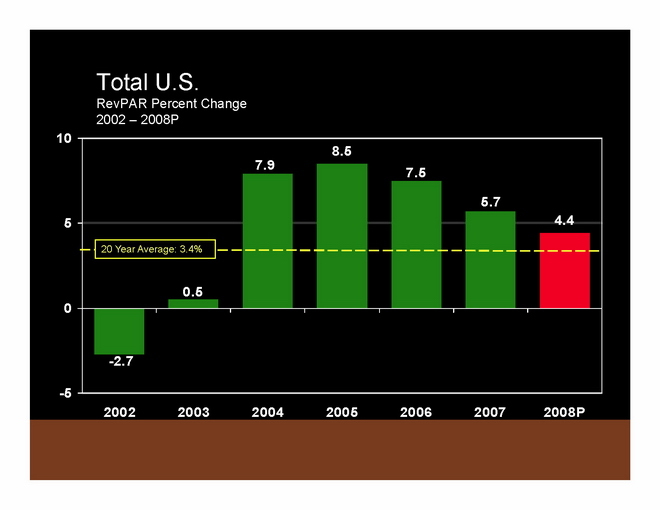

My quick “take-away” summary? Last year was a very good year (5.5% RevPAR growth). This year will be good (4.5% RevPAR growth), all things considered, but it will better for some (luxury, mid segment without F&B, top 25 markets) than others, and there are warning clouds on the horizon.

The ALIS Conference

I am usually in back-to-back meetings through most of the hotel conferences, but I always try to hear Mark Lomanno of Smith Travel and the other industry gurus when they present the latest data and their reading of what it portends. Somehow, I feel better prepared to face the uncertainties of the coming months when I know some of the key data points.

Here are some of the highlights of what Mark Lomanno had to say:

SUPPLY AND DEMAND

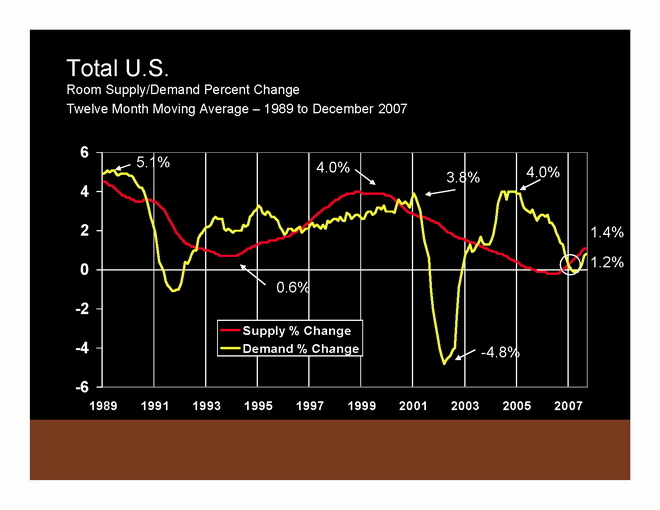

Here is the supply and demand picture. Although many seem more concerned today than they were a few months ago, the hospitality industry was actually in a worse spot 6 months ago than now.

People talk about the year 2007 as being “the year of two halves”- the first half and the second half. They were so different, they did not seem to belong in the same year.

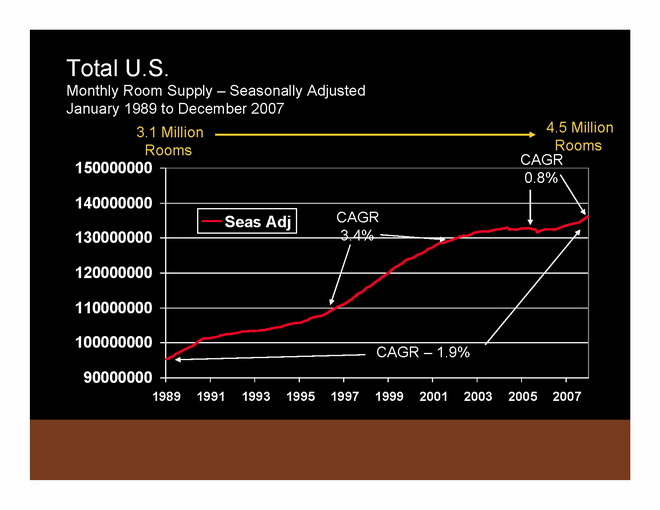

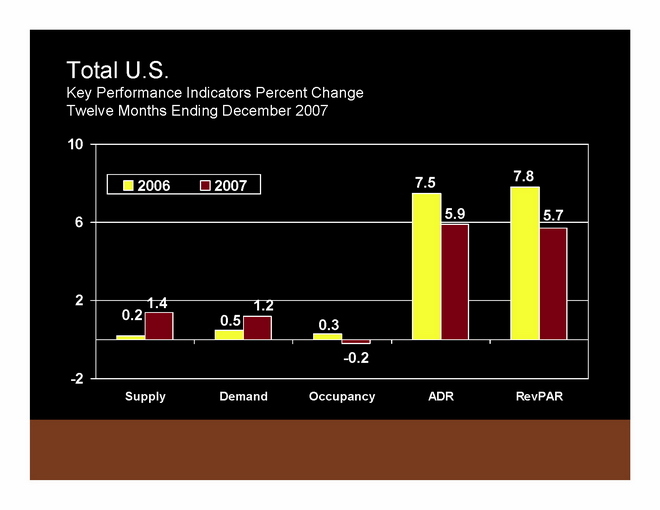

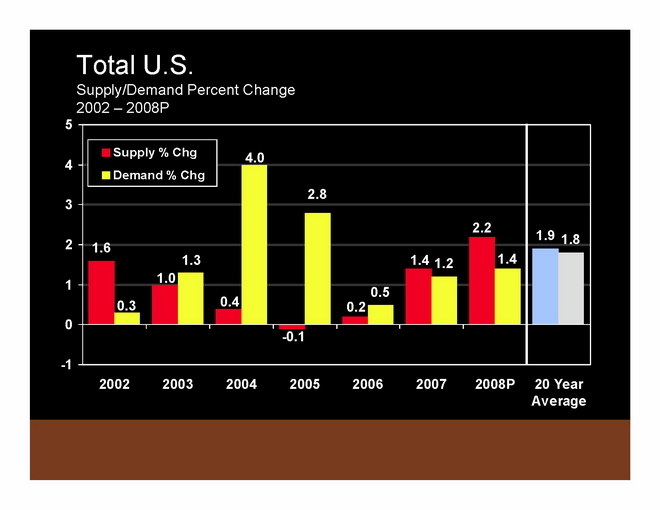

Supply. Over the last 20 years, hotel room supply has grown at an average of 1.9% a year, and right now, room supply is growing at 1.4% (up from .2% in 2006) so it is still below the 20 year average. In prior downturns like 1990-91 and 2000-2002, there was an excess of supply over historic averages. That is not the case today. This bodes well for the industry and distinguishes these times from prior downturns.

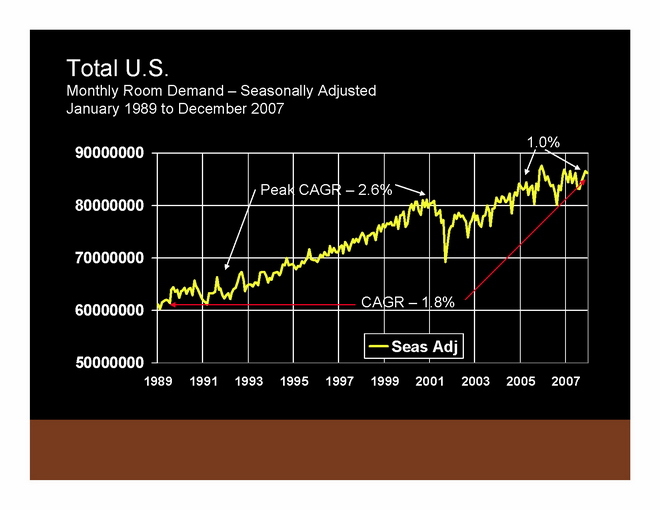

Demand. Over the past 20 years demand for hotel rooms has grown at an average annual rate of 1.8%. The demand situation has actually improved from .5% growth in 2006 to 1.2% growth in 2007.

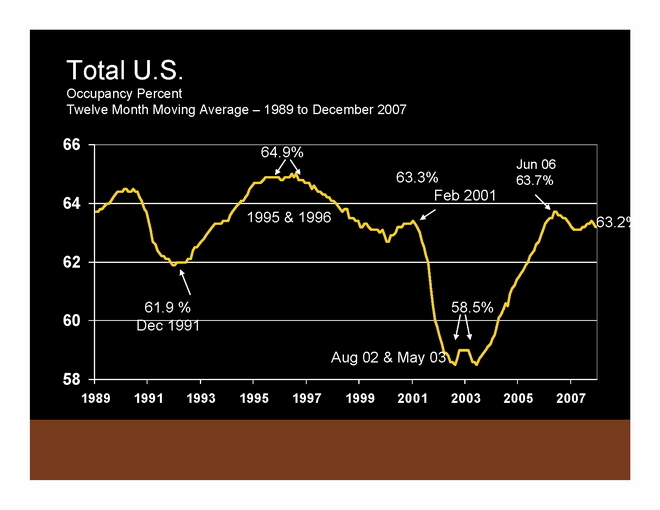

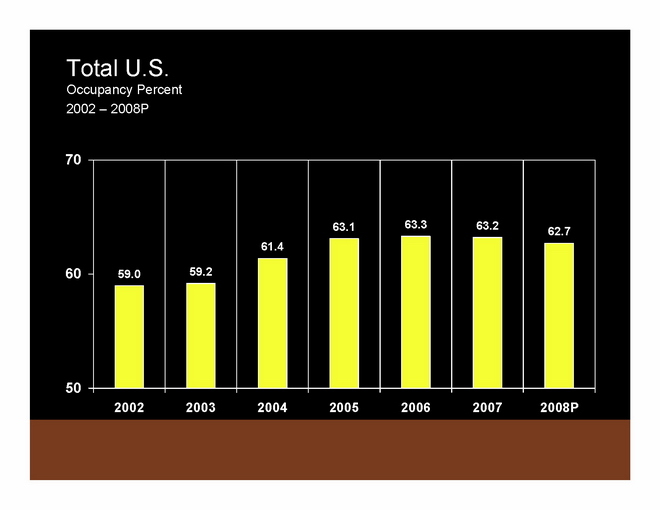

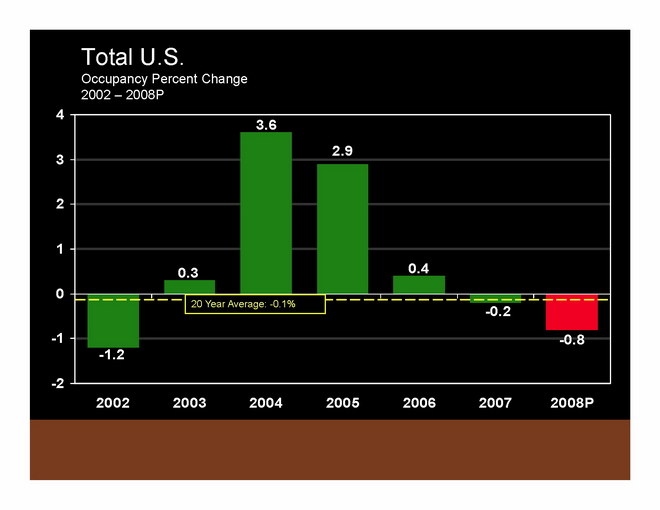

Occupancy. Occupancy is now running about 63.2%, down from 63.7% in June 2006. But this is still a relatively high number. When the industry starts to get into trouble, occupancy usually falls to 62.5% or less, and we are a ways from that.

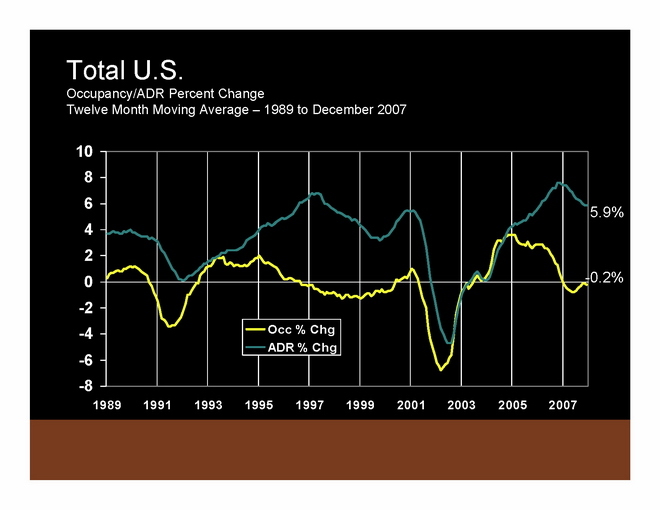

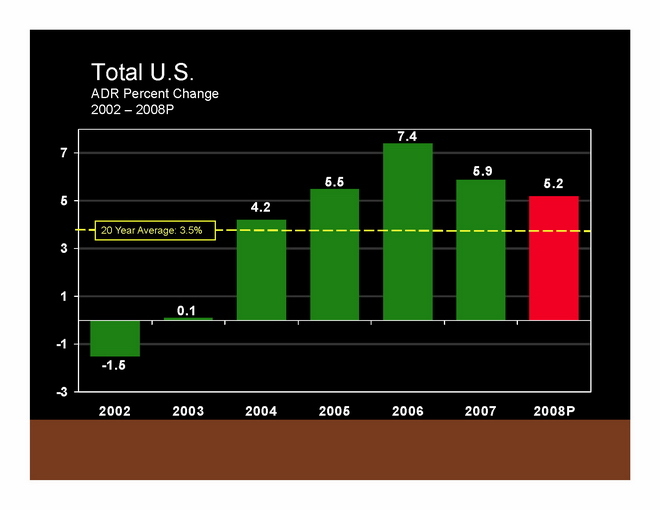

In case you are wondering, Mark says that declining occupancy does not necessarily imply declining rates. There have been some notable periods of occupancy decline when ADR was maintained or even increased. In fact, there was a 46 month period of decreasing occupancy over which rates went up. (Look at those periods starting in 1993, and again in 1995, as well as 2005.) The ADR growth has slowed down a little recently, but that is not serious.

To summarize 2007 compared to 2006: In 2007, ADR was up 5.9% and RevPAR was up 5.7% from 2006 levels. These ADR and RevPAR growth rates are significantly above historic averages. Supply has popped up a little bit, but demand has also come back a bit. Occupancy continues to deteriorate slightly.

As discussed above, 2007 was a very good year for the U.S. And outside the U.S., global markets generally did very well too. Look at the numbers for Dubai, London and Sydney!

WHO WILL FARE BEST IN COMING MONTHS?

As Mark and his colleagues at Smith Travel Research look at recent data, they see some distinctions emerging in likely future performance for hotels located in the Top 25 markets vs. all other markets, and in the upper upscale and upscale vs. economy segments. In fact, they believe they see things unfolding exactly the opposite way they did in the last downturn of 2000-2001.

What happened before?

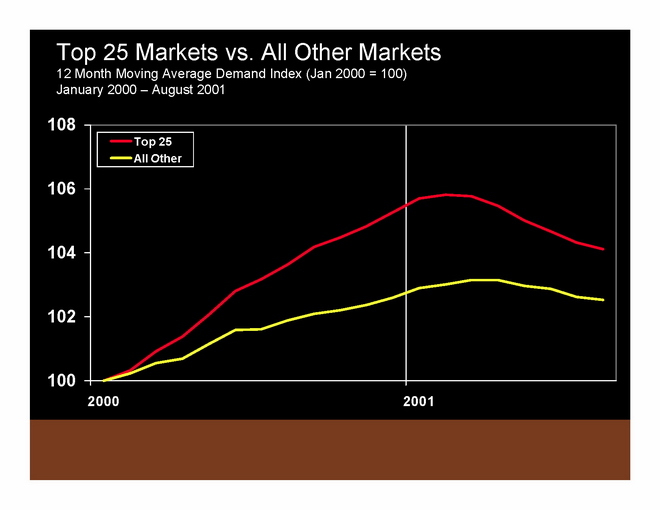

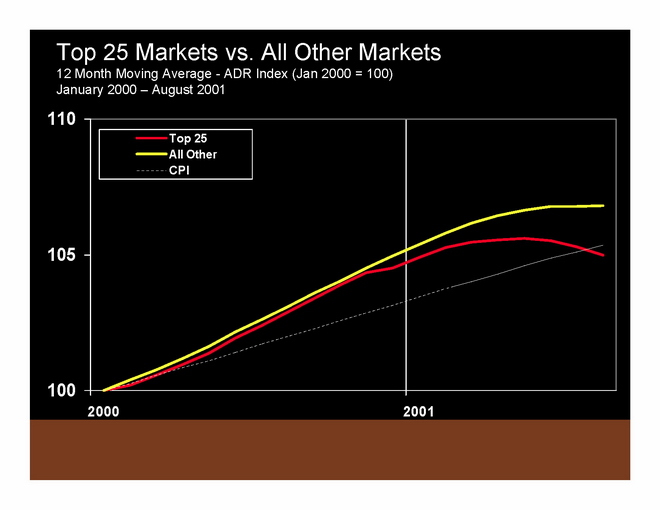

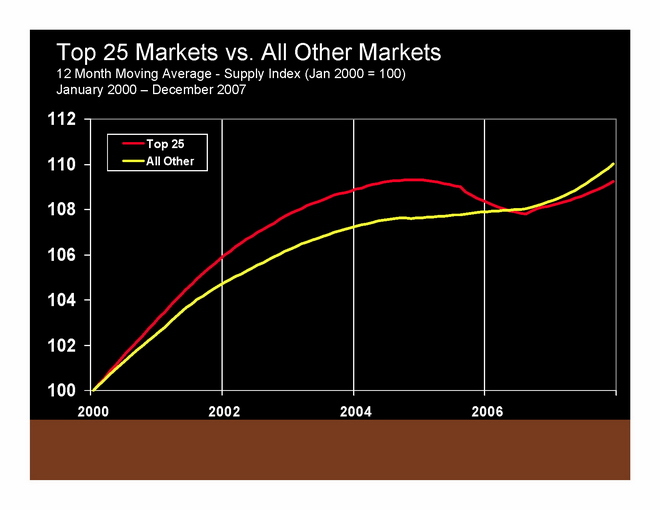

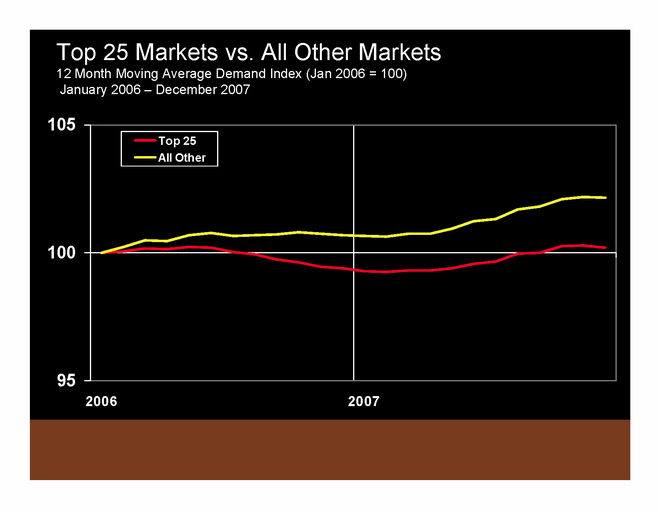

The following slides show what happened in the most recent downturn of 2000-2001.

Performance of the Top 25 markets is shown in red. The first chart above shows supply. In 2000-2001, supply is growing faster in Top 25 markets than in all other markets. In 2005, that all started to change, and since 2005, supply has grown less fast in the Top 25 markets. In fact, rooms have actually come out of the market, and in 2006 the supply growth index for the Top 25 markets fell below all other markets. In the second chart above, you can see how demand started falling off faster for the Top 25 in early 2001.

Also notice how pricing got sluggish for the Top 25 markets in 2000. This was a business-corporate related downturn with leisure remaining strong. But nonetheless, it eroded the price premium previously enjoyed in the Top 25 markets and this negative differential continued to widen in 2001.

But the situation looks different now.

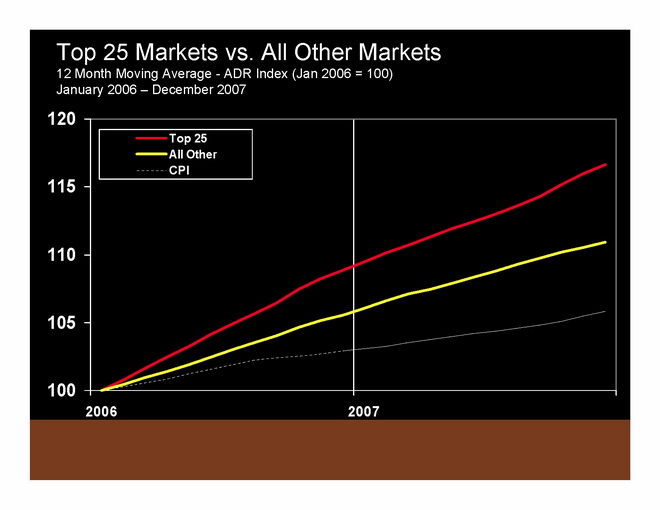

But as we look at 2006, we see that although the demand index for the Top 25 markets has been relatively flat (i.e. slowed down faster than the rest of the country), but with little supply growth, the ADR index for the Top 25 markets has been pulling away strongly from all other markets and from the CPI index. This bodes well for the Top 25 markets in coming months, and suggests that they will outperform all other markets, whether we have good times or more challenges.

If there is a recession (there does NOT have to be), this suggests that it could have a “bottom up” effect on the hotel industry. In other words an economic downturn would have the strongest impact on the secondary and tertiary markets, with the Top 25 markets being least affected and likely to outperform the others.

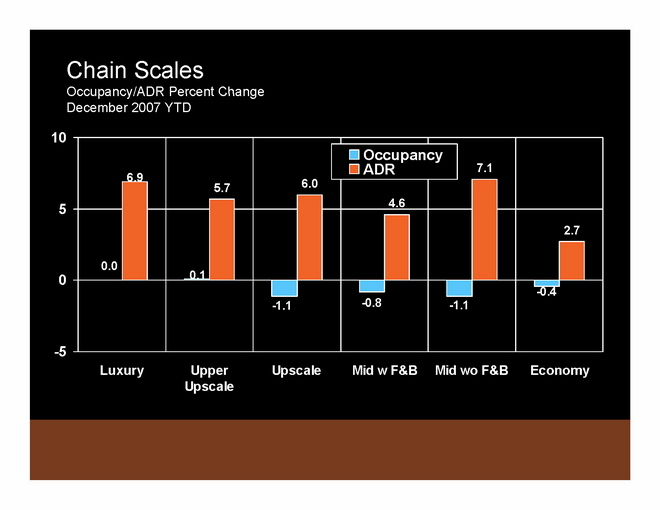

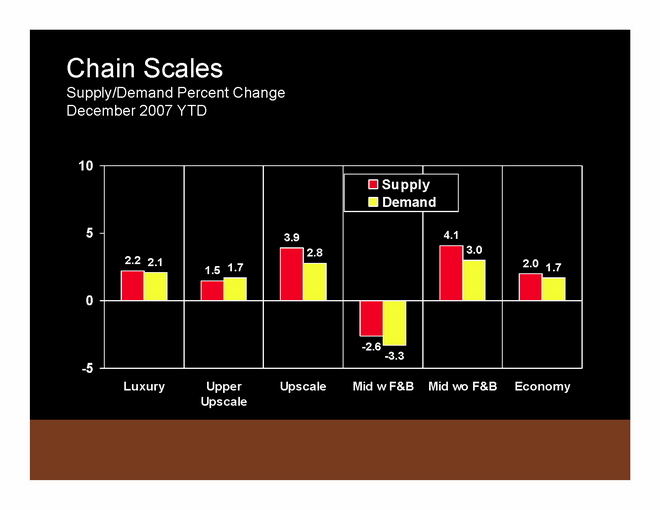

The Chain scale numbers suggest the same thing. The upper market segments (upper upscale and upscale) outperforming the lower economy segment — again suggesting a “bottom up” rather than a “top down” vulnerability to recession.

PROJECTIONS & OUTLOOK

Pipeline

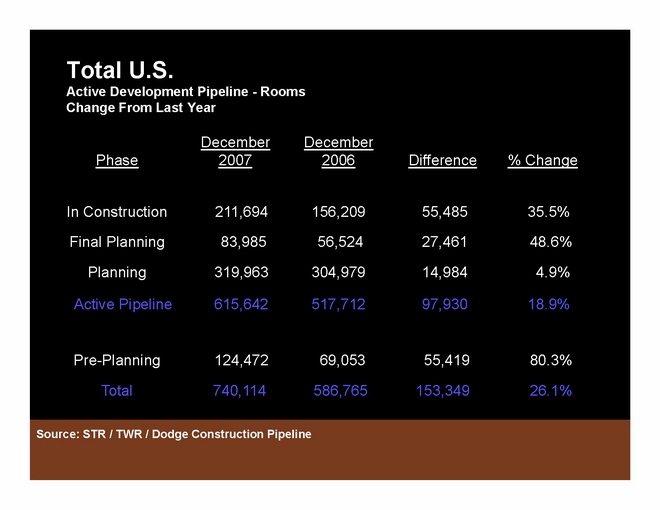

The chart below shows how the supply pipeline continues to kick up. It shows about 211,000 new hotel rooms in construction. Based on historic performance, Smith Travel believes that less than 70% of those rooms will actually open as hotel rooms. In other words, hotel room supply will increase, but not as much as the pipeline numbers suggest.

Supply, Demand and Occupancy

So this is how Smith Travel sums up where we have been and where we are going in terms of supply, demand and occupancy:

And when you put it all together, it shows that last year we enjoyed a 5.7% increase in RevPAR, down from the prior 3 record-breaking years, but nonetheless substantially above the 20 year average of 3.4% RevPAR growth. And compared to the 20 year average, next year’s projected 4.4% looks pretty good — just not quite as good as the last few years.

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and more than 100 hotel mixed-used deals in the last 5 years alone. Who’s your hotel lawyer?

________________________

Our Perspective. We represent developers, owners and lenders. We have helped our clients as business and legal advisors on more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is one of the top hotel lawyers in the world. GOOGLE “hotel lawyer” or “hotel mixed-use” or “condo hotel lawyer” and you will see why.

Jim devotes 100% of his practice to hospitality, representing hotel owners, developers and lenders. Jim leads JMBM’s Global Hospitality Group® — a team of 50 seasoned professionals with more than $87 billion of hotel transactional experience, involving more than 3,900 properties located around the globe. In the last 5 years alone, Jim and his team have assisted clients with more than 100 hotel mixed-use projects, all of which have involved at least some residential, and many have also involved significant spa, restaurant, retail, office, sports, and entertainment components — frequently integrated with energizing lifestyle elements.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them. They are a major gateway of hotel finance, facilitating the flow of capital with their legal skill, hospitality industry knowledge and ability to find the right “fit” for all parts of the capital stack. Because they are part of the very fabric of the hotel industry, they are able to help clients identify key business goals, assemble the right team, strategize the approach to optimize value and then get the deal done.

Jim is frequently quoted as an expert on hotel issues by national and industry publications such as The New York Times, The Wall Street Journal, Los Angeles Times, Forbes, BusinessWeek, and Hotel Business. A frequent author and speaker, Jim’s books, articles and many expert panel presentations cover topics reflecting his practice, including hotel and hotel-mixed-use investment and development, negotiating, re-negotiating or terminating hotel management agreements, acquisition and sale of hospitality properties, hotel finance, complex joint venture and entity structure matters, workouts, as well as many operating and strategic issues.

Jim Butler is a Founding Partner of Jeffer, Mangels, Butler & Marmaro LLP and he is Chairman of the firm’s Global Hospitality Group®. If you would like to discuss any hospitality or condo hotel matters, Jim would like to hear from you. Contact him at jbutler@jmbm.com or 310.201.3526. For his views on current industry issues, visit www.HotelLawBlog.com.