01 October 2008

Hospitality Lawyers at JMBM don’t create economic cycles or events like the Panic of 2008, but we often help our clients and friends find the fortune-making deals or put a tourniquet on life threatening hemorrhaging for owners, developers, investors and lenders.

These times remind this hotel lawyer of some time-tested wisdom. Hetty Green, one of the world’s most successful investors who lived in the 19th century said, “Next to my children I love a good panic more than anything else.” And why would those words be relevant today? That is the penultimate question today at www.HotelLawBlog.com.

The Panic of 2008 will create great opportunities and lethal traps. It no longer matters whether the Bailout Bill passes . . . you will make your own destiny.

The Panic of 2008 is creating investment opportunities and hazards that haven’t been seen for decades. Whether or not the $700 billion bailout bill passes, many will go bankrupt. Many will get rich. But many hundreds of billions of dollars of assets will change hands in the coming months. Cash will be king. Due diligence will matter, and you will find out who your friends really are.

In this article, I want to give you one hotel lawyer’s collection of “idea nuggets” gathered at the recent Phoenix Lodging Conference, some data presented there by the experts, and tell you why the deleveraging of the economy — and the hospitality industry — will create opportunities and problems of the greatest magnitude in recent memory.

Just as Hetty Green loved her children, I love a vibrant, healthy economy and a prospering lodging industry. But I don’t have any silver bullets when the spirits of panic and financial crisis present themselves. So like Hetty Green, next to a vibrant economy, I can find much to love about a good panic. The opportunities are incredible, and they are finally upon us.

The Panic of 2008 — “Idea Nuggets”

I have already talked about the panic of 2008 and won’t repeat the information provided earlier. The Panic of 2008. Financial Crisis impact on the Lodging Industry. Hospitality Lawyer’s take.

But I think some of the “idea nuggets” I gleaned at the recent Phoenix Lodging Conference will set the stage for what is about to happen. Here are a few sound bites I picked up at meetings with industry leaders. I know the authors of all of them, but many are too “shy” or would find it politically unattractive to have their candid views aired in public. All of them are colored by the lenses and beliefs I hold. So brilliance belongs to the speakers, but I take all blame for my perceptions, if wrong.

- Jan Freitag, Smith Travel: “Hold the rate in 08 and maybe we will be fine in 09.”

- Anonymous: In public we say “Hold the rate.” That makes sense as long as we can do it. However, I may have courage to hold the rate in New York or Washington, DC, but I may not have courage to do so in Milwaukee when my competitors start cutting.

- Demand growth will be slightly negative-call it flat this year-while supply grows at 2.5% and occupancy drops. Some predict a modest increase in RevPAR for 2008 while others predict negative growth in RevPAR.

- The “optimists” are hoping for a real recovery in 12 to 18 months, but a consensus seems to be moving toward the conclusion that this situation could be like 1988 or 1989 with a 4 to 5 year . . . . . or longer. . . . . s l o w recovery.

- Cap rates have easily been as low as 5% in the past few years of “bubble” but now they are closer to 7% or 8%. Many think cap rates are headed to 10% or more as they were in the early 1990s (some were at 18% or more). When cap rates double (e.g. go from 5% to 10% –which is literally happening now — property values are cut in half. (see graphic and discussion below)

- David Lowe, Robert W. Baird & Co. The financial crisis has created a situation where money flows to safe havens. 13-week treasury bills have traded at one or two basis points. Banks won’t lend to each other. This is really extreme. This is the equivalent of investors thinking that the world is going to end. The impact on hotel finance is: less debt available, tighter credit terms, commercial real estate asset overhang, refi issues, distressed sales, and higher cap rates. In the next few years, debt service coverage is more likely to be 135% instead of 120%, and LTVs will be at 50% to 60%.

- Steve Van, Prism Hotels and REMIC hotels. We have to realize that any hotel statistics pre Labor Day are meaningless. The hotel world changed Tuesday September 2. Transient business in many markets is down 30% since then. At one point, REMIC Hotels, that manages distressed properties for CMBS special servicers and lenders who have put in a receiver or taken back a hotel — managed a peak of 115 troubled hotels. Today REMIC manages no hotels. But since September 2, things have suddenly gone crazy and we think we will have 30 or 40 new hotel assignments under management by REMIC before year-end.

- Patrick Deming, Eastdil Secured. We are de-levering. There are a lot of people holding assets now who don’t really want to hold them. They missed the sale window. Now they’re looking at a sale at least 3 to 4 years away and it’s very uncomfortable.

- The consumer provides more than two thirds of the GDP growth. As consumer confidence hits all-time lows and job losses kick in, the lodging industry will really hurt.

- In September, we fell off a “cliff” in occupancy. We had a 30% drop in occupancy in hotels in several cities all at once.

- Public markets are factoring in a 20% to 30% decline in EBITDA over the next two or three years. There is also a substantial question about what EBITDA should be used. Should you use EBITDA from 2007? 2008? Or what?

- It does appear that cap rates have moved at least to the 6.5% to 7.5% range for now, up from 4.5% to 5.5% just a little while ago. Most people at the conference seemed to feel that cap rates are now in or will soon touch the 8% to 9% range. Some see 10% to 12%.

- Bernie Siegel, KSL Capital Partners, commented that for the last few years the market has been driven by abnormally high liquidity where investors were paying 5% cap rates on stabilized or peak earnings. Many transactions were driven by cap rate compression, or multiple expansion, which has now reversed itself. Further, we also have the prospect of flat or

declining EBITDA trends over the next two years.

Hospitality Lawyer: What does The Panic of 2008 and the Financial Crisis all mean to us in the hospitality industry?

OK. What do I think? Here it is in straight street English:

- The Liquidity Crisis or Panic of 2008 will be a scary driver in hotel values. First, all the “smart money” will leave hotel financing and hotel purchases for the more lucrative purchase of discounted notes. Why finance or buy properties at “yesterday’s prices” when the lenders, driven by capital emergencies imposed by regulators and accounting rules, are forced to sell their portfolios and notes at deep discounts to get cash. The bailout legislation will not necessarily solve this problem — it depends on the price at which they buy.

- For more than a year, the “smart money” and vultures have been waiting on the sidelines for deep discounts in note values, figuring the lenders would be forced to discount deeply when they could no longer afford to hold. Property owners with well-performing properties would not be first. It has taken a long time, but now the major mortgage bankers are seeing hotel debt regularly being sold at 30% or more discounts. Where possible, companies are buying their own debt because they feel that they are the best bargains in the market. In urgent situations, some debt is now being transacted at $.11 on the dollar even though virtually all of this debt is fully performing (ESA’s mezzanine debt).

- Most hotels continue to perform well, at least in the major markets. According to Jan Freitag of STR, occupancy year to date through August 2008 is still around 70% for luxury, upper upscale and upscale hotels. But if they are starved for capital, because it is all going to deeply discounted notes, sooner or later the value of viable, performing hotels will be driven into the ground. Lower values are created by higher cap rates, falling revenues, fire-sale prices from liquidation of assets of insolvent lenders, and an absence of lenders and buyers in the marketplace.

- Ultimately, the hotel industry is driven by the growth or decrease in the US GDP, the availability of airline seats to take people to destinations, the cost of oil, the increase in hotel rooms supply, and the demand for hotel rooms. The US economy has remained remarkably resilient until now, but is staggering in the Panic of 2008 and the indecisive government position. According the PKF, Airline capacity is being cut and will be cut further before November 1, 2008. The decline in airline seat capacity alone will cause a 1 to 1.5% decline in hotel room demand. Although the cost of oil fluctuates, the generally higher price levels discourage travel for both business and leisure travelers. Hotel rooms supply is increasing at more than 2.5% a year — well above 20 year averages — and is overwhelming the flat-to-declining occupancy growth (i.e. supply growth is overwhelming occupancy/demand growth). We say “hold the rate,” but the will or capacity to resist rate cuts may fall off a cliff.

Benefits and detriments of leverage, and the vicissitudes of changing cap rates and LTVs

We have talked about cap rates and their critical importance on hotel values. They go hand in hand with leverage — debt coverage ratios (DCRs) and loan to value ratios (LTVs).

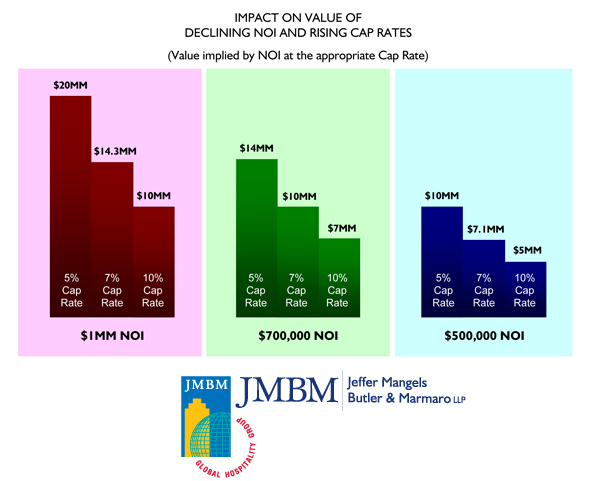

To emphasize this point made earlier about cap rates, if a hotel produces $1 million in NOI, at a 5% cap rate, it is worth $20 million, at a 7% cap rate, it is worth $14 million, and at a 10% cap rate, it is only worth $10 million.

The chart below shows the value implied at three different cap rates — 5%, 7%, and 10% for NOI at $1 million, $700,000, and $500,000. I selected these cap rates because many hotels have been valued in the 5%-6% cap rate range in the past couple years, and many experts at the Lodging Conference seem to think we are headed back to 10% cap rates or more.

Many of the same experts also think that lodging revenues might fall as much as 30% to 50% in some markets. So that is why I applied these 3 cap rates to 3 different levels of NOI — at $1 million, $.7 million (a 30% reduction from the original $1 million NOI), and at $.5 million (a 50% reduction).

Of course it is worth remembering that many are now anticipating BOTH an increase in cap rates AND a decrease in NOI. Therefore, it is entirely possible that a hotel valued only a year or two ago at $20 million (with $1 million of NOI at a 5% cap rate) could be worth only $5 million to $7 million at a 10% cap rate with a 50% or 30% reduction in NOI — down from the original $10 – 20 million based on 2007 NOI.

And in a deleveraging economy, if LTVs (loan to value ratios) drop to 50%-60% from their former 70%-80%, the financeability of a property valued in 2006 or 2007 at $20 million could go from $16 million (80% of $20 million) to $2.5 million (50% of the $5 million valuation resulting from a 10% cap rate on $500,000 in NOI). Numbers will vary, but you see the mind boggling difference between a property that can justify a loan of $16 million (when valued at a 5% cap rate and 80% LTV) to $2.5 million (when valued at a 10% cap rate and 50% LTV). There is a financing “gap” of $13.5 million, when the effects of the hypothetical changes in cap rate, NOI and LTV all collide.

For a fuller discussion of cap rates, please see Hotel Attorney on Hotel Cap Rates. What’s happening to hotel cap rates, values and financing?

Opportunity or Crisis?

It all depends on where you stand. If you have cash and liquidity, you will be KING (or QUEEN). Otherwise, these times may be more than merely interesting, and you may want to consult your hotel bankruptcy lawyer. In fact, even as a King or Queen (with cash), these are likely to be times when your hotel bankruptcy lawyer will be your best friend to navigate these perilous waters. Relationships and access to the “right people” will also be critical.

The hotel lawyers at JMBM have been there and done that. Our team still has the veteran experience from the last great downturn of 1988-1992. We were one of the top 25 law firms in the U.S. for the Resolution Trust Corporation, and handled billions of dollars of troubled assets for the RTC and troubled banks.

Today, we are dusting off our technology and SWAT teams for hotel and real estate workouts, receiverships, bankruptcies and opportunistic buyers. GET READY. It is coming.

To better understand how this all relates to the hospitality industry, please see some other recent articles listed below:

Hotel Lawyer: Uh Oh! Now they are using the “D” word

Hotel Attorneys with the latest “updates from the field”

Hotel Lawyers: How do we pay for this? And what happens next?

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. We’ve done more than $87 billion of hotel transactions and more than 100 hotel mixed-used  deals in the last 5 years alone. Who’s your hotel lawyer?

deals in the last 5 years alone. Who’s your hotel lawyer?

P.S. In case you want to know a little more about Hetty Green (“Next to my children I love a good panic more than anything else.”). According to American Heritage Magazine, in inflation-adjusted dollars, Hetty Green is the richest American woman in history. When she died at age 81 in 1916, her estate was valued at more than $100 million, which would be the equivalent of $17 billion today. In her own day, Hetty was more famous for her eccentricities and her parsimony than for her wealth.

Related articles that may be of interest

- Hospitality Lawyer: $700 billion bailout bill is now law! Warren Buffett insights on (1) Why the Bailout Bill had to pass, (2) The key to making the bailout work, and (3) How the Treasury an make a profit.

- Hotel Lawyer: $700 billion financial rescue bill is signed! Full text of the “Emergency Economic Stabilization Act of 2008”

- Hospitality Lawyer: Fortunes will be made . . . or lost . . . in the wake of The Financial Bailout Bill and the Panic of 2008. What happens AFTER the Bailout Bill . . .

- Agreement on Bailout Bill. The ”Emergency Economic Stabilization Act of 2008″ likely to pass. Sets up the “TARP” for the U.S. economy and the hospitality industry

- Hospitality Lawyer’s take on The Panic of 2008. Financial Crisis impact on the Lodging Industry.

- Hospitality Lawyer with Outlooks and Predictions for U.S. Lodging Industry from The Phoenix Lodging Conference. PKF Consulting’s Mark Woodworth’s presentation.

- Hospitality Lawyer: Pulse of the industry from the Phoenix Lodging Conference. Where are we now? Where are we going?

Our Perspective. We represent developers, owners and lenders. We have helped our clients as business and legal advisors on more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526 or go to www.HotelLawBlog.com.

Jim Butler is one of the top hospitality attorneys in the world. GOOGLE “hotel lawyer” or “hotel mixed-use” or “condo hotel lawyer” and you will see why.

Jim devotes 100% of his practice to hospitality, representing hotel owners, developers and lenders. Jim leads JMBM’s Global Hospitality Group® — a team of 50 seasoned professionals with more than $87 billion of hotel transactional experience, involving more than 3,900 properties located around the globe. In the last 5 years alone, Jim and his team have assisted clients with more than 100 hotel mixed-use projects — frequently integrated with energizing lifestyle elements.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them.