Author of www.HotelLawBlog.com

2 June 2007

Hotel Lawyer on hotel sales, values, buyers and cap rates — reporting from Meet the Money® hotel financing conference. If you are buying or selling hotels, or looking for hotel financing, you have to be interested in today’s posting. This is all about hotel cap rates and values, and the biggest hotel sales as well as the biggest buyers in the recent times. All this information was provided to the crowd attending Meet the Money® a few weeks ago by Suzanne Mellen of HVS International. There is some great information here, that belongs with the other classics on www.HotelLawBlog.com.

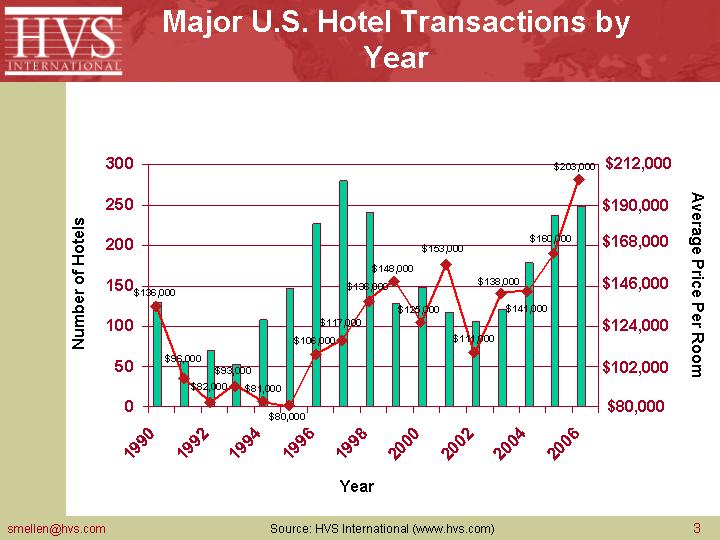

How many “Major Hotel Transactions” and what average price per room?

HVS keeps track of “Major Hotel Transactions” which they define to be transactions for $10 million or more. Suzanne’s first slide, below, show us the volume of these Major Hotel Transactions since 1990. You can see the big peak that we all remember in 1997 and 1998, and we were getting back up to that number of transactions again in 2006, after the downturn in 1999.

[double click the slide to enhance sharpness]

Here is the same data displayed graphically in a bar chart This format makes it a little easier for some of us to see the trends.

[double click the slide to enhance sharpness]

This time the average price per room is over laid on the transaction volume graphic. It is interesting to see how the average price per room correlates with transaction volume

[double click the slide to enhance sharpness]

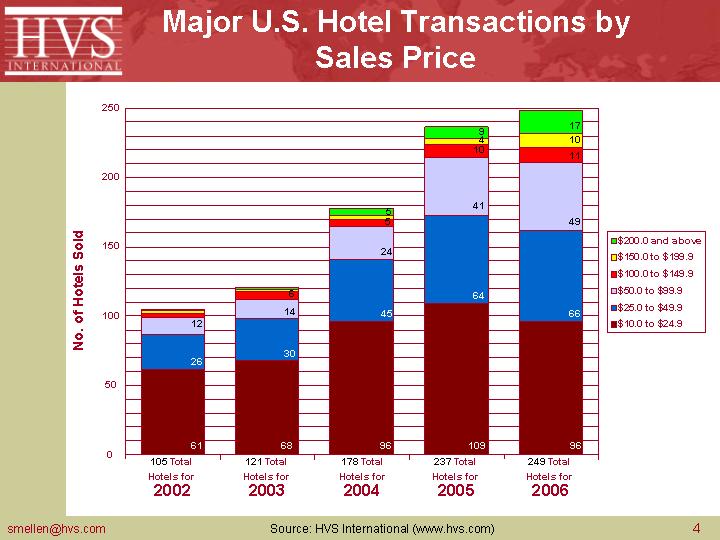

Suzanne gave us another graphic portrayal of the hotel sales transactions and price per room in this stacked bar chart, showing greater detail on average price per room for the transactions over the past few years.

[double click the slide to enhance sharpness]

The BIGGEST transactions and buyers.

I always like to see the “biggest” lists. Here is Suzanne Mellen’s list of biggest hotel transactions by price per room:

[double click the slide to enhance sharpness]

and by total sales price . . .

[double click the slide to enhance sharpness]

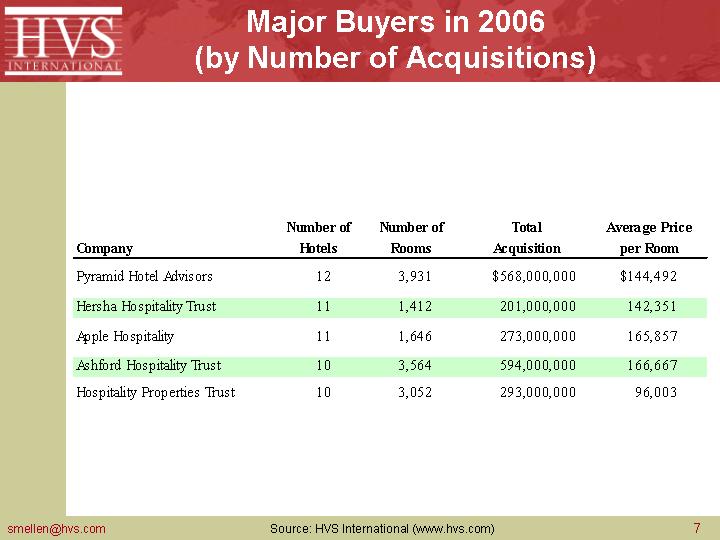

and the biggest buyers last year by number of transactions:

[double click the slide to enhance sharpness]

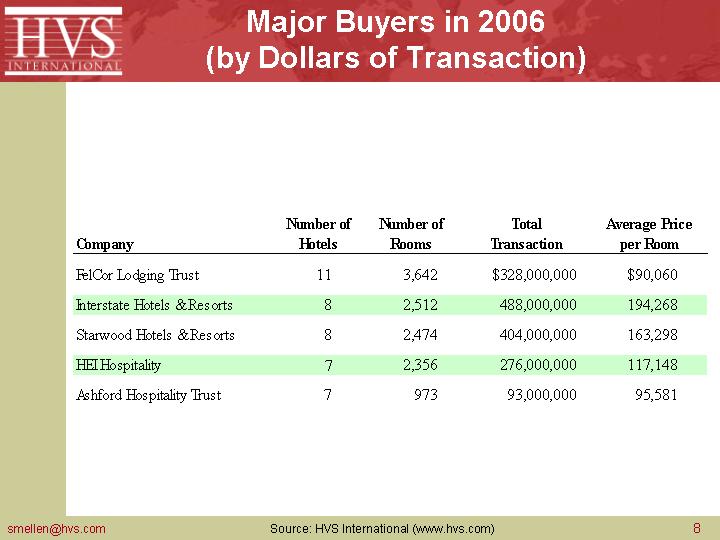

and biggest buyers by dollars spent on hotel acquisitions:

[double click the slide to enhance sharpness]

Cap Rate Comparison (1994-2006)

Finally, Suzanne gave her graphic showing cap rates for hotels and other real estate classes from 1994 through 2006. You can see why investors have found hotels to be so attractive with their higher cap rates, but that difference is diminishing.

[double click the slide to enhance sharpness]

Where does it all end? I am not sure that anyone knows, but I just arrived in New York where I will be attending the NYU Hotel Conference along with a record crowd, and I will share any new perspectives I get with you shortly.

________________________

Suzanne Mellen, Managing Director of HVS International, can be reached at 415.268.0351 or SMellen@hvs.com.

________________________

Our Perspective. We represent developers, owners and lenders. We have helped our clients as business and legal advisors on more than $125 billion of hotel transactions, involving more than 4,700 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Jim Butler is one of the top hotel lawyers in the world. GOOGLE “hotel lawyer” or “hotel mixed-use” or “condo hotel lawyer” and you will see why.

Jim devotes 100% of his practice to hospitality, representing hotel owners, developers and lenders. Jim leads JMBM’s Global Hospitality Group® — a team of 50 seasoned professionals with more than $87 billion of hotel transactional experience, involving more than 3,900 properties located around the globe. In the last 5 years alone, Jim and his team have assisted clients with more than 90 hotel mixed-use projects, all of which have involved at least some residential, and many have also involved significant spa, restaurant, retail, office, sports, and entertainment components — frequently integrated with energizing lifestyle elements.

Jim and his team are more than “just” great hotel lawyers. They are also hospitality consultants and business advisors. They are deal makers. They can help find the right operator or capital provider. They know who to call and how to reach them. They are a major gateway of hotel finance, facilitating the flow of capital with their legal skill, hospitality industry knowledge and ability to find the right “fit” for all parts of the capital stack. Because they are part of the very fabric of the hotel industry, they are able to help clients identify key business goals, assemble the right team, strategize the approach to optimize value and then get the deal done.

Jim is frequently quoted as an expert on hotel issues by national and industry publications such as The New York Times, The Wall Street Journal, Los Angeles Times, Forbes, BusinessWeek, and Hotel Business. A frequent author and speaker, Jim’s books, articles and many expert panel presentations cover topics reflecting his practice, including hotel and hotel-mixed-use investment and development, negotiating, re-negotiating or terminating hotel management agreements, acquisition and sale of hospitality properties, hotel finance, complex joint venture and entity structure matters, workouts, as well as many operating and strategic issues.

Jim Butler is a Founding Partner of Jeffer, Mangels, Butler & Marmaro LLP and he is Chairman of the firm’s Global Hospitality Group®. If you would like to discuss any hospitality or condo hotel matters, Jim would like to hear from you. Contact him at jbutler@jmbm.com or 310.201.3526. For his views on current industry issues, visit www.HotelLawBlog.com.