30 October 2023

See how JMBM’s Global Hospitality Group® can help you.

Click here for the latest articles on ADA Compliance and Defense.

Many hotel owners already know they need to pay attention to Americans with Disabilities Act (ADA) compliance, both to provide a positive experience for guests and to avoid costly litigation. A proposed new California law, however, should bring their focus to website accessibility; if adopted, business owners, as well as their web developers, would be vulnerable to substantial statutory damages and attorney’s fee if sued by a plaintiff who succeeds in court.

JMBM’s ADA Compliance and Defense Team outlines the potential impact of this law, below.

New California Website Accessibility Bill

Would Expose Your Business to ADA and Unruh Act Liability

by Martin Orlick, Stuart Tubis, and Christopher Whang

JMBM’s ADA Compliance & Defense Group

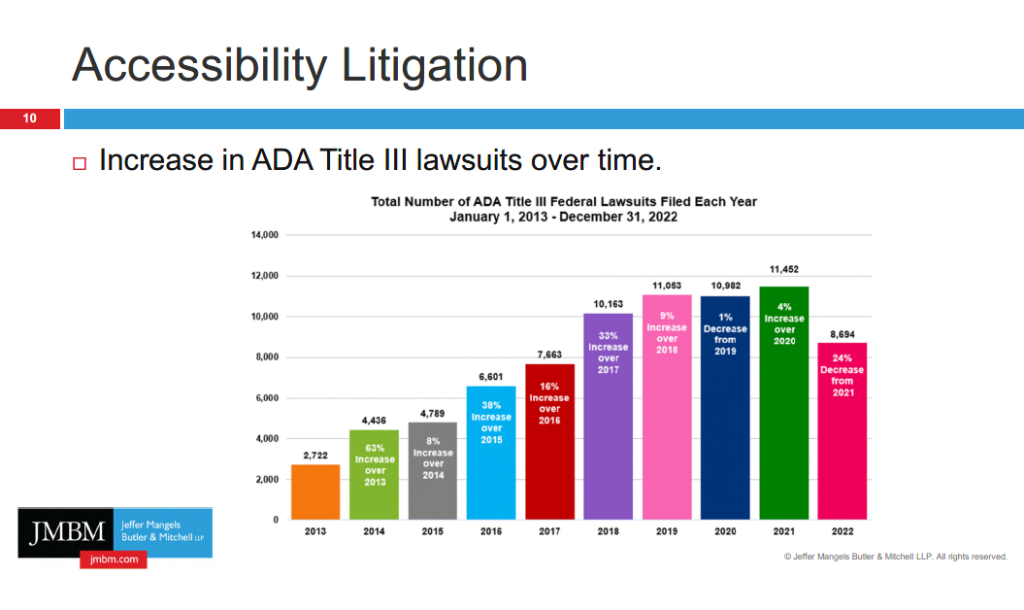

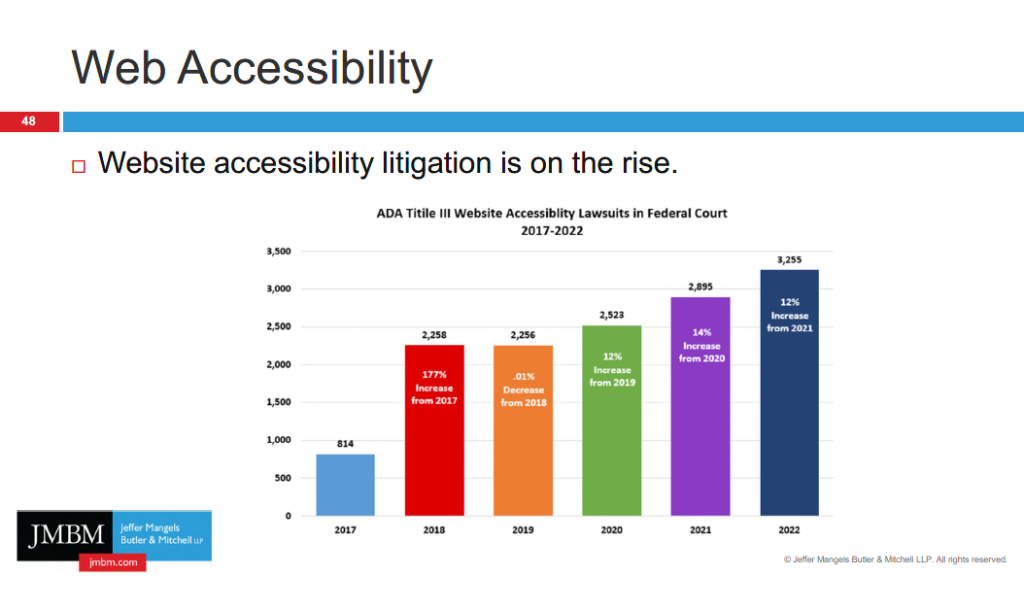

Recently, the California Assembly quietly instituted a bill that would dramatically change the landscape of ADA website litigation. If you think the recent wave of ADA website lawsuits has been alarming, buckle up – because you haven’t seen anything yet.

The Assembly re-drafted an existing bill, AB1757, which if passed would include the adoption of the Web Content Accessibility Guidelines (“WCAG”) 2.1 into California’s disabled access law. AB1757 specifically would give plaintiffs the right to sue businesses if their website fails to meet those guidelines, which are not yet part of Federal accessibility law. Additionally and perhaps more alarming, if passed into law, the legislation would give ADA plaintiffs a direct claim to sue you and your web developers.

A plaintiff who prevails under AB1757 will be entitled to collect all damages, including but not limited to, statutory damages of $4,000 every time a person who is blind, low visioned or cognitively disabled visited your website or was deterred from visiting the website, as well as attorney’s fees resulting from the lawsuit.

To whom would AB1757 apply?

If passed, AB1757 would apply to all public businesses that own or operate a website for the sale of goods and services. AB1757 also would apply to “resource service providers,” or website developers, who operate, maintain, and/or build websites for public accommodations. CONTINUE READING →

Stuart K. Tubis is a partner attorney at Jeffer Mangels Butler & Mitchell LLP and a member of JMBM’s ADA Compliance & Defense Group. Stu counsels businesses and landlords on the full spectrum of ADA compliance issues and represents their interests in litigation and Department of Justice investigations. He has a background in technology, which helps in resolving the growing area of website accessibility issues. Contact Stuart K. Tubis at 415.984.9622 or

Stuart K. Tubis is a partner attorney at Jeffer Mangels Butler & Mitchell LLP and a member of JMBM’s ADA Compliance & Defense Group. Stu counsels businesses and landlords on the full spectrum of ADA compliance issues and represents their interests in litigation and Department of Justice investigations. He has a background in technology, which helps in resolving the growing area of website accessibility issues. Contact Stuart K. Tubis at 415.984.9622 or  This is

This is